Layer 1 Protocols Report

The Decentralized Finance market grew by 47% in 2021 to a value of USD 106 billion. VC’s deployed USD 30 billion globally into the cryptocurrency space in 2021 and NFT sales grew 250 times to a volume of USD 24.9 billion. All of this was made possible by blockchains.

In this article we will go over what a layer 1 blockchain is, what the characteristic properties of a blockchain are, why there are multiple layer 1 blockchains and then go over the unique aspects of some popular layer 1 blockchains.

Layer 1 blockchains, often referred to as decentralized ledgers or distributed databases are the backbone of the entire Web3 infrastructure. When you carry out a transaction, when you buy an NFT, or when you deploy a smart contract that data tends to be stored, in bundles called ‘blocks’, with each new block that is created being linked to the previous one forming a layer 1 blockchain, so named because it is the most fundamental layer on which the data is stored.

Unlike a centralized database where only certain individuals have access to the data, where the data can be modified at any time and where the data is lost if the database shuts down, on the blockchain the data is immutable, which means that one cannot go back and alter it (without putting in more resources than one would gain), it is decentralized, so instead of being located in one particular location, all the computers that are participating in the blockchain network have a copy of the data, and all the data on the blockchain is public and can be viewed by anyone.

All the aspects of different layer 1 protocols can be grouped under 3 core properties, Decentralization, Security and Scalability.

Decentralization refers to how easy it is to set up a node, i.e. a computer that participates in the network by validating transactions and storing the blockchain data. If it is prohibitively expensive to set up a node then there will only be a select few validator nodes and the ideal of a decentralized network where anyone can participate in verifying transactions and storing the blockchain data will be lost.

Security refers to the ability of malicious actors to take control of the entire network, prevent transactions from being added to the blockchain or even going back and altering existing transactions.

Scalability is the number of transactions the blockchain can handle over a given time period.

Now that we have understood what a layer 1 blockchain is, the next question is why are there so many of them? (There are currently around 100 layer 1 blockchains protocols)

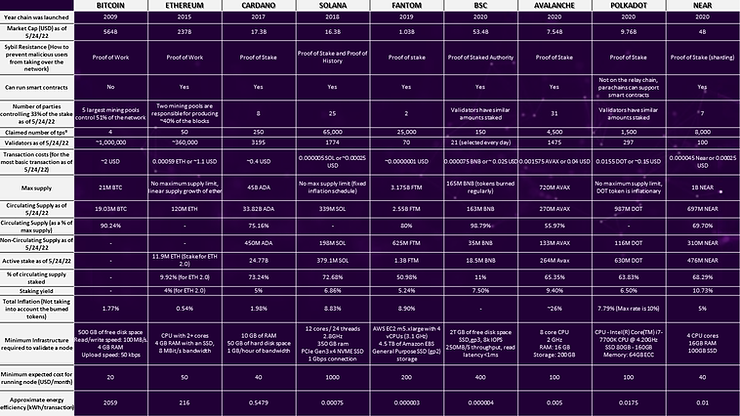

A reason why there are so many different blockchains is that different protocols lay differing amounts of emphasis on the above 3 properties. For example Bitcoin is very decentralized and secure but suffers on scalability, Solana is highly scalable however it suffers on decentralization due to the high costs associated with setting up a node. Different layer 1 protocols can have different block sizes, validator requirements, consensus algorithms all with the purpose of improving one or more of the above 3 properties.

Another reason is that there is a limit to the number of transactions any single blockchain can process (this goes back to the scalability property) and as this limit is approached it becomes more costly and time consuming to carry out transactions on that blockchain.

An obvious question would be, why can’t we just increase the block-size (blocksize is currently 1Mb for bitcoin) or the rate at which blocks are mined (1 block is mined every 10 minutes on the bitcoin blockchain), this is because if you arbitrarily increase the blocksize/rate you are going to need more expensive equipment to be able to mine the blocks, this makes the network more centralized and a centralized network can in turn make it easier for malicious actors to take control of the network.

Therefore, as more and more people start carrying out transactions on the blockchain you will need multiple layer 1 chains to accommodate all the transactions. Thus being able to study and compare different layer 1 blockchains is all the more imperative.

Before looking into what makes layer 1 protocols unique it is important to establish an understanding of the foundational features of blockchains, these include features like consensus mechanisms, tokenomics and governance that are common to all blockchains. We have provided an overview of these foundational topics before highlighting the novel implementations of some of the popular layer 1 chains.

Security features: Consensus, finality and validators

Every blockchain protocol makes sure to advertise its security and the consensus protocol it uses to get the validators to agree on valid transactions that are then added to the blockchain. Rightly so, when you have a system which does not have a central authority you can contact in case of a mistake or fraud, you would want to be extremely sure that no fraudulent transactions can get recorded in the first place.

The concepts one should be familiar with while analyzing the security of blockchain protocols are: Sybil resistance and consensus algorithms. These define how the blockchain can be secured to contain honest transactions and how all the honest nodes taking part in verifying the transactions and maintaining the blockchain can agree on the state of the blockchain.

The two major ways to secure the network are Proof-of-Work (PoW) and Proof-of-Stake (PoS). The way the PoW algorithm ensures that miners submit honest nodes is by miners having to spend computational resources (i.e. power and equipment) to produce the block. You might have heard about how blockchain mining is extremely energy intensive, consuming around 91 terawatt hours of electricity annually, which is more than the electricity consumption of Finland. That is precisely due to the PoW algorithm that miners have to follow in order to produce a block. The block then serves as ‘proof’ that the miner has spent a certain amount of computational power in solving a mathematical expression that could not have been solved without carrying out the required computations (i.e. you have ‘worked’).

The other algorithm blockchains use to ensure the validity of transactions is PoS. In PoS, validators stake (put up as collateral) their tokens for a chance to produce the block of transactions. If they try to subvert the network the tokens they have staked will be confiscated/destroyed. PoS is much less energy intensive than PoW because now instead of a physical resource (computational power) the validators are instead putting their tokens on the line to ‘prove’ that they are indeed producing valid blocks.

Bitcoin and Ethereum the two largest networks use PoW while most of the other layer 1 chains use some form of PoS. Ethereum has been planning to switch to PoS however the transition is still underway at the time of writing this article.

Another important concept to be aware of is finality. Finality refers to how long after a block is produced can we be certain that this block is valid and continue adding new blocks to this block.

Finality can be probabilistic or deterministic. In cases where finality is probabilistic users wait till a number of additional blocks are added on top of a particular block in order to be sure that the particular block is final. The idea behind this is that as more and more blocks are added on top of a particular block the probability that a malicious attacker can go back and change transactions in that block drops drastically.

In the case of deterministic finality, users can be sure that as soon as a block is produced that the transactions in that block are final and will not be changed.

Chains have to make a tradeoff between probabilistic finality or deterministic finality. In deterministic finality one can be sure of transactions after they have been added to a block on the chain, however if a predetermined number of validators (usually ⅔ of the total number of active validators) cannot reach a consensus on whether a block should be added to a chain or not the protocol stops producing blocks, thus no new transactions can be added and the system comes to a standstill.

In the case of probabilistic finality, blocks are continuously added to the blockchain, however no block is ever truly final, the probability of a block getting invalidated decreases as more blocks are added to it. Now even in the case of probabilistic finality blockchains updates are being made that prevents blocks added before a certain time period from being invalidated. Thus ensuring finality for older blocks.

Tokenomics

We can’t talk about creating a new financial system from the ground up without talking about the ‘money’ that will be used in that financial system. Tokens are a central part of layer 1 blockchains. If blockchains are a ledger in which transactions are written then the tokens are the units in which those transactions are recorded.

All the layer 1 blockchains we talk about have a native token, Bitcoin has BTC, Ethereum has ETH, Avalanche has AVAX, etc. These tokens are utility tokens and are used to pay for the transaction costs on the blockchain, they are used to vote on governance related issues, they are the denomination in which block producers and developers that contribute to the blockchain are rewarded. Different layer 1 protocols reward validators/miners in different ways, for example in the Polkadot protocol the transaction fees are distributed evenly among validators who are actively validating, whereas in Avalanche the transaction fees are burnt (i.e. destroyed)

They are also used to secure the network in the case of proof of stake blockchains where validators stake the native tokens for a chance of producing blocks. Since the native tokens are staked in order to validate the transactions the price of the native tokens becomes even more important, as protocols with less expensive tokens will be easier to take over by buying up the native tokens.

Since native tokens are generally not backed by any physical goods, for them to have value certain constraints must be placed on them. One of these being scarcity and another being the ability to produce native tokens. In order to retain their value the native tokens should be scarce and follow a well defined and controlled production schedule.

For some protocols like bitcoin the number of tokens are capped at 21 million, the only way new tokens enter circulation is as a reward to miners for producing blocks. There are other tokens that do not have a cap on their total supply but have set inflation schedules which can be altered using a referendum of the token holders.

Another important consideration for native tokens is that their value should have some positive correlation with the level of adoption of the blockchain protocol. As a way of rewarding the token holders and incentivizing them to be evangelists of the protocol the value of the token should increase (generally done by decreasing the token supply) as more and more people start using the protocol.

Application ecosystem and interoperability

Blockchains have come a long way since its first mainstream use by Bitcoin in 2008. Bitcoin started off simply by allowing users to send bitcoin to one another without the need of an intermediary. Then in 2017 Ethereum introduced smart contract functionality to the crypto community. Smart contracts have been described as a digital vending machine, in the sense that you have certain inputs and if those meet the preset criteria, the contract produces predefined outputs. If bitcoin is a distributed ledger in which users could write their transactions, ethereum’s introduction of smart contracts can be thought of as introducing a distributed computer, that enabled more complex processes like Decentralized Finance (DeFi) and NFT’s.

The ability to deploy programs on the blockchain gave rise to DeFi and NFT’s both of which have become billion dollar industries.

Thus the presence of applications built on top of the layer 1 blockchain that unlock specific use cases such as an NFT marketplace, a decentralized exchange, borrowing and lending protocols etc are very important for the adoption and growth of the blockchain. Since ethereum was the blockchain that introduced smart contracts the largest NFT marketplaces and DeFi applications are all on Ethereum, with the size of the markets of ethereum’s apps being orders of magnitudes greater than those of its competitors.

While these services on the Ethereum blockchain were created by third parties, teams that are developing newer layer 1 blockchains are developing features like exchanges and lending/borrowing protocols themselves in order to attract users who are used to the existence of these features on the older chains.

In order to get users of existing layer 1 protocols onto their own chains the creators of the newer chains are also laying a great emphasis on developing bridging solutions that allow users to transfer their assets from one chain to another. Protocols like NEAR and Avalanche both have bridges that can allow users to transfer their assets from ethereum onto their own blockchains.

While newer protocols may be creating these bridging solutions to further their own user base, it leads to a more interoperable crypto ecosystem on the whole and is a net positive for the space.

Governance and community participation

Unlike fiat currencies that are backed and controlled by nation states, cryptocurrencies are not backed by a particular country or organization. Their value is dependent on what the adopters of that cryptocurrency have attributed to it. Therefore the governance of the blockchains is of paramount importance. The layer 1 blockchains are all open source which means their code is available online for people to see. While this means that anyone can copy the code and start their own layer 1 blockchain, and in fact this has happened to crypto projects in the past, the competitive moat in cryptocurrency projects is its community. People who own the native token of that blockchain like DOT in case of Polkadot, SOL in case of Solana have a say in issues concerning that blockchain. They can vote on aspects like the token policy of the chain, i.e. if the blockchain should issue more tokens, they can vote on updates to aspects such as if the chain should modify its consensus algorithm, the requirements to become a validator of that chain, changes to transaction fees etc. Hence a layer 1 blockchain in which users have a say in the governance and where voting power is not concentrated among the few is one that users can have more faith in.

Apart from community governance the blockchains also have foundations that fund innovative projects on the chain, help support developers who maintain and contribute to the code powering the blockchain. These foundations fund these activities through the chain’s native tokens and tend to hold a significant amount of the circulating supply of the chain’s tokens. They can be thought of as a board of directors, who hold a significant amount of the company stock and hence are financially vested in its success. A good foundation that supports developers is key to having an innovative layer 1 blockchain, because with the code being open source no single person or company owns the code and thus the incentive to develop and build off the existing code is provided by these foundations. Without a foundation to support the developers and spur innovation and without an active community that has chosen to collectively agree that the cryptocurrency has value the chain will be reduced to a ‘zombie’ chain.

Thus keeping track of the foundation, how often updates to the chain have been made and how active the community is, is a good way to judge the innovativeness of the chain

While most of the popular blockchains offer users a similar set of features there are aspects that set them apart. We will go on to highlight the unique aspects of some popular layer 1 blockchains.

Prior to joining Delta, Smit was Co-Founder and CTO of CoinCrunch India, which is one of India’s first crypto news platform Smit has worked with various Indian exchanges including CoinDCX, CoinDelta and various projects in technical capacity.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.