Looking Forward to 2025

2025 will be one of the most pivotal years for crypto due to the expectations of pro-crypto policy regulations, technical upgrades across various ecosystems such as Firedancer on Solana and Pectra on Ethereum, and an increase in enterprise adoption.

Let’s dive into the ‘2025 in Review’ section. This report is divided into the following 11 sections that we believe had the most impact on the industry last year and will help us form an opinion on our predictions for next year:

- Unlocking Bitcoin

- ETH Approval and Market Impact

- Programmability on Bitcoin

- Technical Upgrades

- Scalability and Staking

- Institutional Adoption/ RWA

- Stablecoins

- Regulation

- L-1/L-2 Ecosystems

- Sector-Specific activity across chains

- Are L-2s parasitic to Ethereum?

- Upcoming Ecosystems

- Consumer

- Prediction Markets

- Memecoin Mania

- Decentralized Social

- Telegram

- DeFi

- Hyperliquid

- Uniswap

- Pendle

- Aerodrome

- DEX vs CEX

- DeSci

- Restaking

- AI x Crypto

- AI Agents

- Decentralized Compute

- Coordination Platforms

- Data

- Are ICOs making a comeback?

1. Unlocking Bitcoin

2024 was a pivotal year for Bitcoin. It included a halving event, BTC reaching a new all-time high, approval of spot Bitcoin ETFs, scaling and programmability primitives being launched on the network, and BTC being an important point of discussion in the US election.

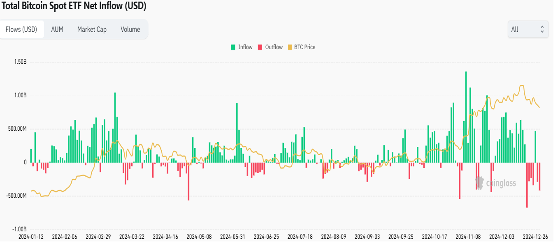

ETF Approval and Market Impact

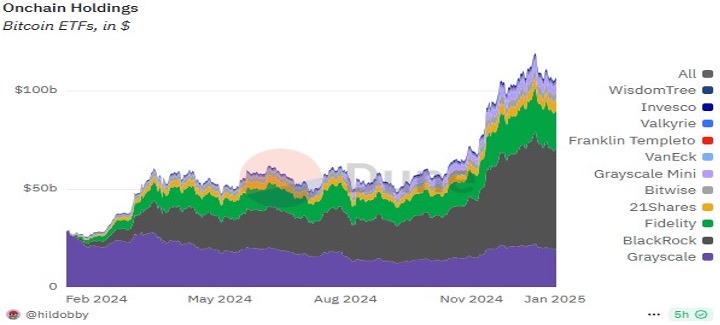

The approval of around 11 Bitcoin Spot ETFs, such as the Blackrock’s IBIT, was transformative in 2024. IBIT attracted significant institutional interest, achieving $3 billion in assets under management (AUM) within 30 days and $40 billion in 200 days—a record for new ETFs. By the year-end, the US Spot ETF Balances stood at $109.38B. These vehicles reshaped market dynamics, driving Bitcoin’s dominance from 52% to a peak of 62%.

The ETF issuers hold around 1.1M BTC, with Blackrock dominating the market share at 48%, followed by Grayscale’s GBTC at 18.3% and Fidelity’s FBTC at 18.2%. Currently, around 5.7% of the Bitcoin supply is in backing ETFs.

Bitcoin ETF On-chain Holdings. Source

Apart from the ETFs, a major factor driving up the BTC price has been the approach taken by Michael Saylor’s MicroStrategy(MSTR) to DCA into buying BTC. As of 12/30/24, MSTR owns 446.4k BTC, which is around 2% of the total 21M BTC supply. The average cost per BTC for the firm has been $62,428. To assist the buying spree, MSTR has raised $6B in the past 10 months by selling convertible notes at a near 0% interest rate, and intends to raise at least another $18B over the next three years. This approach has raised concerns in the market due to the systemic risk present because at the time of maturity, which is between 2027 and 2032, the holders can choose to convert the notes into equity at a pre-determined price or redeem them for cash, and with a non-zero chance that the BTC price goes below MSTR’s avg. cost per BTC, MSTR may be forced to sell its BTC at unfavourable terms, or need to roll over debt, or in the worst case, face bankruptcy, leading to a Black Swan event.

Programmability on Bitcoin

Historically, the core proposition for Bitcoin has been as a Store of Value, with limited functionality and programmatically. However, as the asset gained value, there seemed to be a massive liquidity of around $1.3T(~70% of the Bitcoin supply) sitting idle.

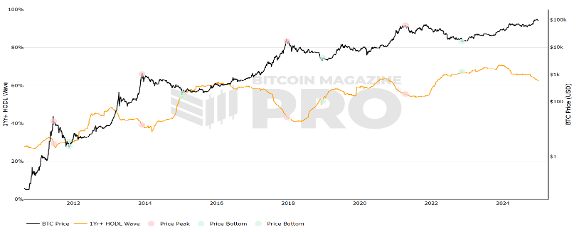

At the end of 2024, 62.3% of BTC holders had held on to it for at least a year. Source.

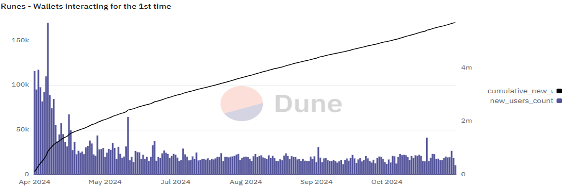

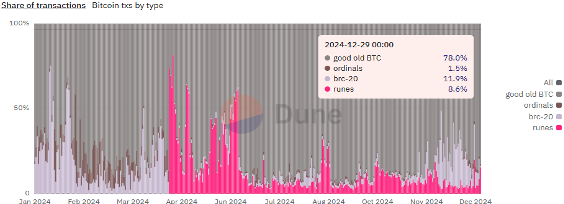

Hence, to unlock that supply and overcome the functionality capability to enable Bitcoin DeFi, some innovations such as Bitcoin SegWit and Taproot upgrades were undertaken in ‘17 and ‘21 respectively. These helped Bitcoin enhance privacy, scalability, and programmability through increasing block capacity, introducing Schnorr signatures, and laying the groundwork for Layer-2 solutions. However, Bitcoin programmability really picked up with the launch of Ordinals by Casey Rodarmor and the release of BitVM paper in 2023, followed up with Runes in April’24. Ordinals are Bitcoin’s answer to NFTs. They are essentially any digital data that can be inscribed on top of a Satoshi, the smallest unit of Bitcoin. Some leading projects; all with more than $100M market caps, include Bitcoin Puppets, NodeMonkes, and Quantum Cats.

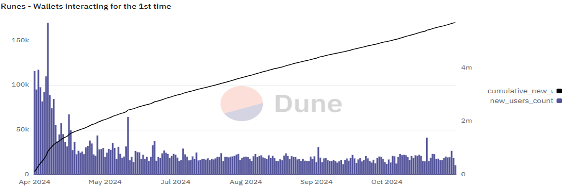

Runes are Bitcoin’s answer to ERC-20s on Ethereum or the ability to launch alt/cultural tokens on Bitcoin, without changing anything on the native Bitcoin network.Some leading projects include DOG GO TO THE MOON, and Pups.

Source

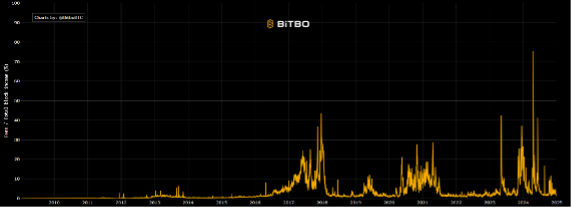

Ordinals and Runes saw early demand, however the hype has mostly died down since then due to a lack of adoption. The trend in Bitcoin keeps on shifting with each new narrative seeing a boom and then a lull cycle. However, even though the asset hype might be short-lived, they can have a significant impact on the long-term Bitcoin blockspace when revenue and profitability of a miner is concerned. This is especially true since the profitability of a miner depends on block subsidies, which half every year and currently stand at 3.125 BTC/block. These subsidies will go to zero once all 21M Bitcoin are mined. Therefore, with new asset classes, the miners can make more due to increased transaction fees. As can be seen from the graph, the fees as a percentage of income hiked to 75% post the launch of Ordinals in 2023. However, most of these new asset classes are currently only hype, and as the way things stand with Bitcoin, we don’t expect them to gain massive attraction, unless significant technical upgrades are made to the protocol.

Fees as a percent of total block reward for miners. Source

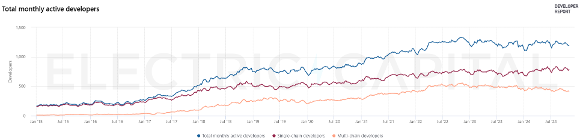

Such innovation on Bitcoin has also led to an increase in dev activity. According to the Electric Coin Developer report, Bitcoin is the 8th most active ecosystem, with 359 full-time and 1.2k monthly active devs who have cumulatively committed 10M repos so far.

Technical Upgrades

As most blockchains that suffer from the Scalability Trilemma- maintaining the optimum balance among security, decentralization, and scalability, Bitcoin has had its fair share of troubles as well. To overcome the restraints caused by the scripting language functionality, many historical changes have been proposed/made to the protocol, including SegWit Upgrade, Taproot Upgrade, and Covenants. Furthermore, Opcodes were disabled by Satoshi Nakamoto in 2010 to help prevent DoS attacks. However, due to the upgrades in the protocol, especially around transaction sizes and client-side validation along with the growing demand to improve programmability on Bitcoin, new upgrades are being proposed, including:

- Bitcoin Improvement Proposal 347: This proposal aims to enable Ethereum-style complex smart contract functionality on Bitcoin. The idea is to allow the OP_CAT opcode, which effectively allows users to concatenate data i.e. consolidate two unique pieces of data together during a transaction. The OP_CAT upgrade can be passed through a soft fork hence making it less disruptive to the network.

- OP_NET: Currently in the testnet phase, the idea is to create a meta protocol system to allow anyone to permissionlessly deploy smart contracts on Bitcoin. According to its founder, Chad Master, the protocol would support both fungible and non-fungible tokens, only allow transaction fees to be paid in BTC, and use WASM based smart contracts.

- BitVM: Proposed by Robin Linus, the BitVM paper was a breakthrough in Bitcoin because it allows for Turing-complete contracts and verifies any type of complex computation through on-chain proofs. BitVM uses an optimistic style approach in which all off-chain transactions are considered valid, unless proven otherwise.

- BitVM2: Building on top of the previous proposal, BitVM2 helps to reduce on-chain transaction complexity through SNARK verification. It also introduces BitVMBridge, to help bridge BTC to other L2s. BitVM2 aims to be more secure by enabling any Bitcoin full node to dispute a transaction.

- CatVM: Developed by the Taproot Wizards team, CatVM is a permissionless bridge that allows for transfer of BTC and other Bitcoin-native assets between an L1 and an L2. It claims to be a better alternative than BitVM due to reduced trust and liquidity requirements.

Scalability and Staking

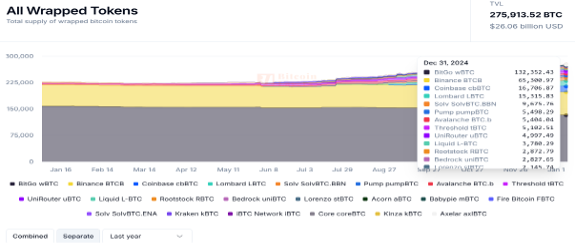

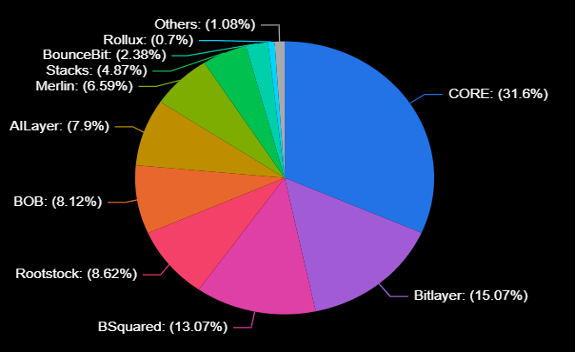

According to BitcoinLayers, there are currently around 51 Bitcoin L2s with a total supply of $28.66B in different wrapped bitcoin tokens. Sidechains are dominant at the moment and zk rollups are playing catchup. Most of the protocols are EVM compatible, with exceptions such as Stacks, Lightning Network, Libre. Some Bitcoin L2 AltVMs include Molecule, Yona Network(SVM), and Nexio(MoveVM).

There has also been an increase in the supply of wrapped bitcoin tokens across the networks to help in Bitcoin DeFi. BitGo’s wBTC currently leads the race, however it came under recent scrutiny from the crypto community due to controversies surrounding centralization and custody risks due to Tron’s Justin Sun involvement with the project. Hence, there has been an increase in players trying to capture the market share, with Binance BTCB, Coinbase cbBTC, and Lombard LBTC leading the race.

Even though nascent, we’re also seeing a rise in Bitcoin-backed Stablecoins to support the booming DeFi activity. The ones leading the charge include Bima’s USBD($1B in BTC TVL committed), Hermetica’s USDh, and Ducat’s UNIT.

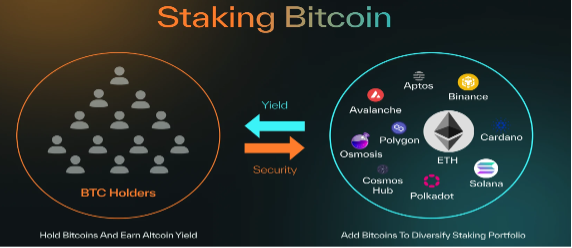

In 2024, we also saw a new utility being added to the Bitcoin ecosystem in the form of Staking.The idea of staking is to leverage the massive economic security of Bitcoin to secure other PoS(Proof-of-Stake) chains. Pioneered by Babylon, without giving up the control of their Bitcoin, users secure alt ecosystems while earning yield in return. The phase one of Babylon’s self-custodial mainnet went live in Aug’ 24, with a cap of 1k BTC, with a phased rollout planned for 2025. We believe this will have a positive impact on the BitcoinFi ecosystem, leading to greater activity within the ecosystem.

Similar to the restaking innovation that was accomplished by EigenLayer on Ethereum, we saw it emerging in the Bitcoin ecosystem as well with Pell Network leading the charge. The idea of restaking is to repurpose the security of BTC stakers to other protocols and services and help Bitcoin transition from being just a ‘store of value’ to a ‘value creation’ asset. Similar to EigenLayer’s AVS, Pell introduces Decentralized Validated Services(DVS) that leverage the Bitcoin cryptographic security through their cross-chain BTC restaking network. The project currently has a TVL of around $400M and 470k cumulative stakers.

The approval of the Bitcoin ETF has made BTC accessible to more than 62% of Americans with convenience. Currently, BTC is the 7th most valuable asset in the world, having already crossed Silver, and as BTC gains adoption, especially, if the talks around a ‘Strategic Bitcoin Reserve’ to help fight US national debt materialize, we’ll see more ETFs being filed.

Furthermore, with rising inflation across the globe we’re seeing citizens turning to Bitcoin to preserve their savings. This is especially true for regions such as LATAM, and Africa which have seen inflation reaching as high as 140%. As regulations improve, with the new pro-crypto US government leading the charge, we’ll see more countries adopting Bitcoin.

From a scalability standpoint, we’ve seen an increase in Bitcoin L2s post the BitVM paper due to the innovation in on-chain Bitcoin proofs. These L2s are primarily sidechains, and not rollups, due to various trust assumptions. Similar to other ecosystems, these L2s also suffer from poor UX and liquidity fragmentation.

Our 2025 Prediction:

However, even with the limitation of Bitcoin’s scripting language, and the UTXO-based architecture, we expect to see an increase in Bitcoin Side-chain TVL from the current ~$2.62B to more than $4B, with 30+ more L2s being launched in 2025, and an increase in protocols helping unlock Bitcoin liquidity in a trustless manner. These advancements will be possible due to Babylon’s next phase of mainnet rollout, BitVM2 upgrades, increase in dev activity on Bitcoin, novel use cases such as Payments, Decentralized Identity, Staking etc., and the need to make mining loss-proof in the future. We also expect developers to propose more technical upgrades to the Bitcoin blockchain this year, as was seen last year. We do expect 2025 to test the capacity on Bitcoin Defi. Based on that, we at Delta have invested into Pell Network and Bima

Bitcoin Sidechains TVL Distribution. Source.

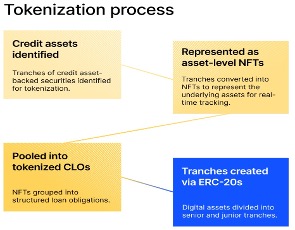

2. Institutional Adoption/ RWA

With the BTC and ETH ETF approval legitimizing cryptocurrencies, we saw an increase in new allocators entering the asset class. Apart from these asset managers, we also saw an increase in institutions trying to adopt blockchain technology to reduce transaction costs, improve efficiency, remove third-party intermediaries, and increase transparency.

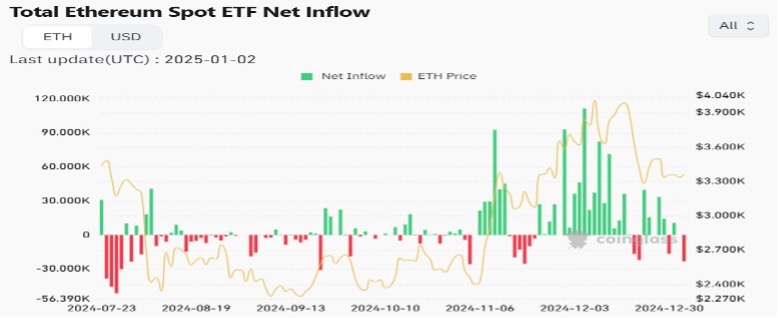

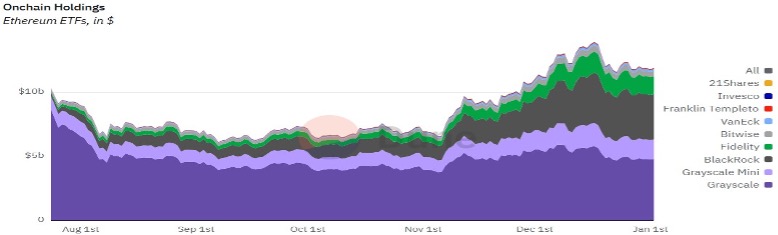

The ETH ETF has a market cap of $12.33B with 2.89% of the current ETH supply backing the ETFs. Currently, Grayscale’s ETHE dominates the market share at 40.2%, followed by Blackrock’s ETHA at 29.7% and Fidelity’s FETH at 11.8%.

Ethereum ETF On-chain Holdings. Source

Other ways in which institutions are adopting crypto include:

- Visa: Through the Visa Tokenized Asset Platform(VTAP), banks are able to issue fiat-backed tokens on-chain. VTAP is interoperable across both permissionless and permissioned blockchains, can be easily integrated through API-based access and can be programmed to automate workflows. We expect numerous banks to start using the pilot in 2025 to help settle cross-border payments, as the lines between crypto, fintech, and TradFi blur.

- BUIDL: Blackrock launched its first tokenized product, an on-chain money market fund called BUIDL in March’ 24. Initially launched on Ethereum, the fund has expanded to 5 more chains and currently has $648M in Total Asset Value. The idea of BUIDL is to be able to provide investors access to on-chain products and offer instant settlement across platforms. The fund has an APY of 4.5%, with Blackrock charging 0.2-0.5% as management fees.

Breakdown of the BUIDL fund by chains. Source

- Centrifuge x BlockTower: BlockTower Capital, along with MakerDAO used Centrifuge to launch their $220M securitization fund. By doing the securitization process on-chain, they were able to eliminate the network of intermediaries- custodians, trustees, agents, minimize the settlement times, reduce costs by 97% from millions to only $60k, and provide a transparent view of the process to all the stakeholders.

- Project Agora: Pioneered by the Bank of International Settlements in April’ 24, the project brings together 7 leading central banks, and 40 private sector financial firms to explore how tokenization can help with cross-border payments.

- Ondo: Ondo is a leading platform for getting institutional-grade finance on-chain. In 2024, its tokenized US treasury product, OUSG grew to $200M in TVL, and USDY, a permissionless yieldcoin grew to $451.13M in TVL. USDY is compatible across a number of ecosystems, such as Arbitrum, Ethereum, Plume and Aptos. Furthermore, by partnering with LayerZero, Ondo is pioneering crosschain functionality of RWAs.

- Securitize: Securitize has tokenized $1B+ on-chain assets, with leading products such as BlackRock’s BUIDL fund, Hamilton Lane’s Evergreen private credit fund, and KKR’s Healthcare fund.

- JPM Kinexys: Kinexys is JP Morgan’s blockchain platform to help enable cross-border and tokenization.

- Central Banks: Apart from US Senators proposing for a ‘Strategic Bitcoin Reserve’, there has also been growing interest from global central banks and lawmakers to add Bitcoin to their reserves, including the Czech National Bank, Brazilian Lawmaker, Russian Lawmakers, and Canada.

Our 2025 Prediction:

Going forward, we expect global institutions to increase their exposure to blockchain-based assets and also use the technology to improve efficiencies in their systems. We’ve already seen an interest from global pension funds allocating to companies with crypto-exposure, such as MicroStrategy, and within the US, some state pension funds such as Michigan and Wisconsin already allow for BTC ETF exposure, with Pennsylvania and Florida expected to follow suit.

BTC adoption by categories. Source

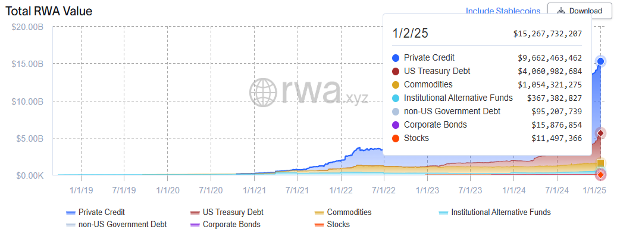

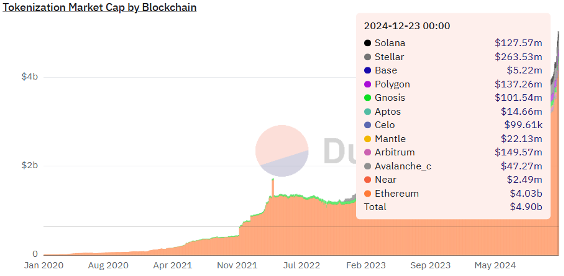

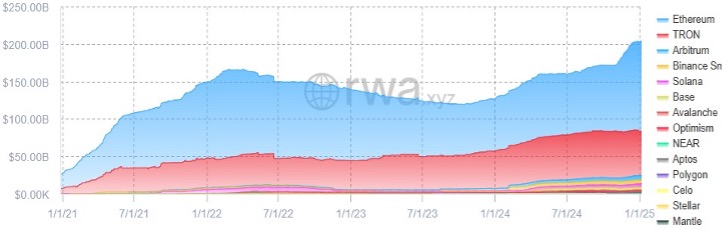

In 2024, the Total RWA on-chain was $15.27B, excluding stablecoins which had a market cap of $202.24B.

Total RWA on-chain(ex-Stablecoins). Source

The RWA market cap increased from $8.39B in 2023 to $15.34B in 2024, and we expect this trend to continue. We’ll also see newer asset classes such as equities, renewable energy, collectibles, IP like Music, and real estate gaining more adoption on-chain.

We also expect increased adoption of “Degen Products” from more Wall Street veterans with on-chain tokenized versions of Money Market Funds, Private Credit, Equities, and Bonds gaining adoption. Furthermore, we expect more banks to launch their own Layer-2s, similar to what Deutsche Bank did to help with cheaper cross-border settlements.

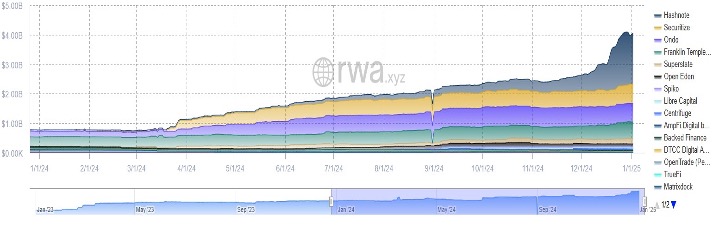

- Money Market: Leading this race will be the tokenized money market funds which currently stand at $4B and we expect them to grow to more than $8B this year as more issuing entities enter the space, asset managers get comfortable with regulations and newer blockchain ecosystems emerge. Tokenized MMFs with embedded digital FX swap- such as the POC launched by Citi and Fidelity will eliminate delays in the management of global treasury positions and enhance portfolio diversification. Currently, Hashnote dominates the space with a 41.97% market share, followed by Securitize’s 16.34%, Ondo’s 15.53%, and Franklin Templeton’s 13.57%. From an ecosystem perspective, Ethereum leads the race, capturing 72.5% market share, followed by Stellar’s 7.23%, and Solana’s 3.37%.

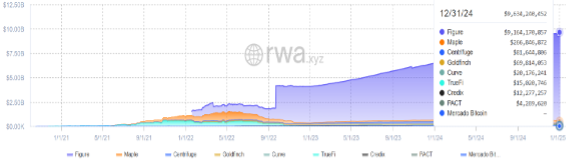

- Private Credit: A $1.6T market in TradFi, the current on-chain loan value is only $9.67B, or only 0.6%, leaving a massive market untapped. With an average APR of 9.92% and most of them emerging from developing economies like India, Philippines, Kenya, and Nigeria, we believe this sector has huge potential for growth. From a sector perspective, auto, consumer, and real estate lead the race. Furthermore, since most private credit loans are not over-collateralized, the yields generated on them are higher than what someone can get by depositing stablecoins on DeFi lending protocols. Currently, Figure, a TradFi company doing Home Equity Line of Credit loans dominates the space with a 94.7% market share with assets tokenized on the Provenance blockchain. We expect this market to increase by at least 50% as crypto-native firms such as Maple, Centrifuge, and Goldfinch expand to other ecosystems such as Ethereum, Solana, and Aptos.

- Equities: Still in its infancy, the on-chain equity market is only 0.02% of the US stock market. Tokenized equities provide individuals with a 24/7 trading opportunity with no risk of halting and for individuals in emerging market economies access to international equity markets, which otherwise would be hard to reach. We believe this segment to grow as regulations become clearer.

Furthermore, we expect more alt tokens ETFs such as Solana, XRP, LTC, and HBAR to be filed this year. According to Polymarket, there’s an 87% chance of a Solana ETF approval in 2025. We believe there’s a high chance that staking in ETH ETFs can be approved this year which would help funds reduce the management fees, provide more yield to investors, and increase the overall Ethereum staked. The biggest hindrance to the approval is the complex regulatory landscape, risks of slashing penalties along with lockup requirements, and the potential for market manipulation. It is more likely that the ETH staking ETF will be first approved in Europe than in the US.

3. Stablecoins

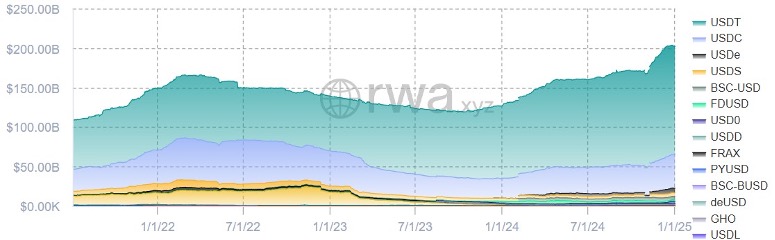

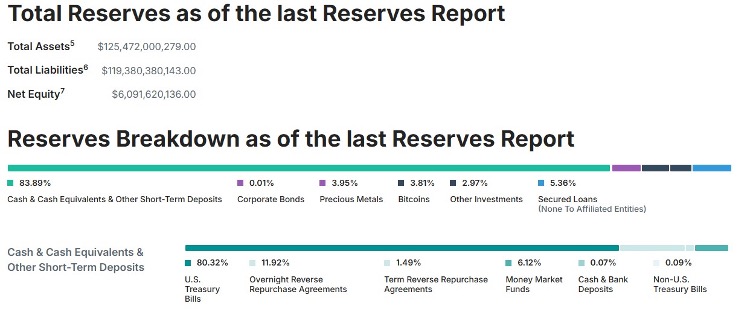

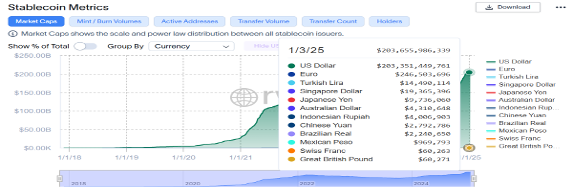

Stablecoins seem to have found a true Product-Market-Fit amongst all the crypto assets, and continue to grow at a massive rate, and have grown by ~60% from last year to a 202.24B market cap. Almost .97% of the US M2 Money Supply has been tokenized. Stablecoins have a monthly transfer volume of almost $4.17T through 24.95M monthly active addresses, and a total of 140.93M holders. Furthermore, Stablecoin issuers are currently the 18th largest holders of US treasuries, at around $135B, which is more than countries like Germany and South Korea. Projects have undertaken different approaches to help maintain the peg of their asset for their respective markets, for e.g. Usual through its decentralized fiat-backed protocol, Reserve through its inflation-adjusted currency backed by tokenized assets, Schuman through its Euro backed stablecoin EUROP, Bilira for its Turkish backed stablecoin, and PayPal through a centralized fiat-backed stablecoin.

Catering to the requirements of an individual, there are different types of stablecoins. Apart from the regular stablecoins which we are aware of such as Tether USDT($136.88B in supply) and Circle USDC($44.34B in supply) which are pegged on a 1:1 basis with real-world currencies, 2024 saw new types of stables emerge. These new stables arrived to overcome the drawbacks of their predecessors, which included being prone to systemic failure such as when USDC depegged in 2023 due to its exposure to Silicon Valley Bank, facing regulatory hurdles, having counterparty and centralization risks since the issuing authorities have been forced to freeze assets in the past.

Breakdown of USDT reserves. Source

New Type of Stablecoins that emerged included:

- LRT backed: This is a new type of stables that became popular post the restaking narrative picking up. These are over-collateralized debt positions against multiple LRTs. The leading examples include Ebisu Finance ebUSD, Prisma Finance ULTRA, and f(x) rUSD. These are highly risky due to the volatile asset backing them, and even though they cumulatively reached a market cap of around $15M in 2024, the asset class is pretty much dead now post the hack and failing to gain adoption.

- BTC collateral: These stables are Over-collateralized debt positions against BTC collateral. The leading ones include Bima’s USBD($1B in BTC TVL committed), Lambda Finance’s btcUSD, and Ducat’s UNIT. We believe that these stables will play an important role in unleashing Bitcoin DeFi, and are permissionless and efficient assets.

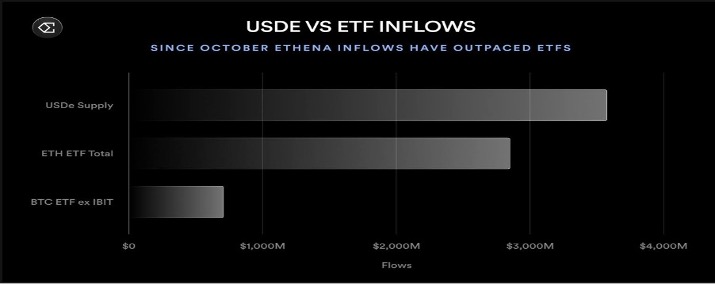

- Yield-bearing: Ethena’s USDe is a synthetic dollar that is backed by a ‘delta-neutral’ strategy. USDe is able to maintain a 1:1 peg by going long spot stETH(and BTC) while taking an equivalent short position on an ETH perpetual(and BTC perpetual), hence the net effect offsetting both positions. The protocol has a governance token called $ENA. The overall risks associated with it include negative funding rates, collateral risk, and oracle/smart contract risks. Even though Ethena is only almost an year old protocol, it has grown very fast. USDe is the 3rd most popular stable with a $5.85B market cap and was sitting only at almost $100M in the beginning of 2024. USDe was the fastest stable to reach $5B in supply and currently offers around 20% APR.

USDe inflows outpaced aggregate ETH and BTC ETFs exc.IBIT since October.Source

The Stablecoin market is heavily dominated by USD at 99.8% of the market share.

Stablecoin breakdown by currency. Source.

Our 2025 Prediction:

In 2025, we expect the lines between TradFi and DeFi to blur. Ethena will help drive that adoption through its innovations such as USDtb which is backed by BlackRock’s tokenized money market fund, BUIDL, and iUSDe, a TradFi-wrapped sUSDe to help traditional financial entities use on-chain stablecoins. We also expect stablecoin issuance to be one of the most profitable businesses to be in with record-breaking revenue per full-time employee numbers. For e.g., for Circle it is $3M, MakerDAO is at $6.1M, Tether is at $39.2M, and Ethena is at $46.2M. This is also an opportunity for other protocols to emerge and gain market share. Furthermore, from an ecosystem perspective, Ethereum dominates the market share at 59.07% but we expect other networks such as Avalanche, Solana, and Base to increase their share as well. We expect the USD dominance in stablecoin to slide down a few basis points as countries across the globe work on the regulations, particularly in Europe, Singapore, and Hong Kong. 2024 was the year of the emergence of new types of stables such as yield-bearing and LRT-backed. This year as Babylon gains adoption, we expect to see an increase in staked BTC-backed stablecoins to expand the Bitcoin DeFi ecosystem. Overall, we expect the Stablecoin vertical to expand, and close 2025 at a $400B market cap riding on the fact that new stablecoins will be issued, we’ll have better regulatory clarity, and we’ll see deeper distribution due to platforms like Telegram.

4. Regulation

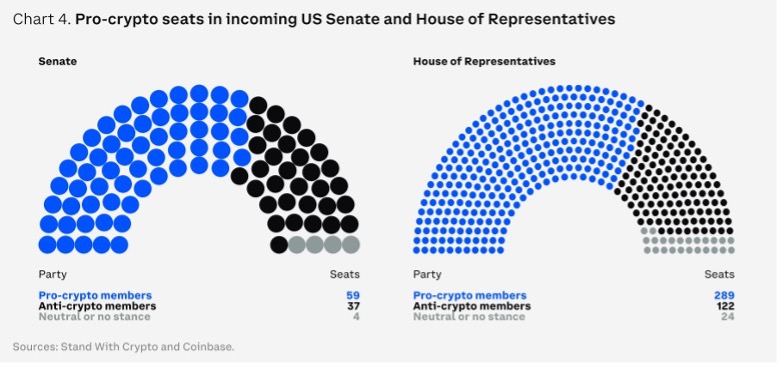

2024 had a rocky start from a regulatory perspective in the US, with the SEC continuing their case against Coinbase and Binance for acting as unregistered securities, and even sending out an Enforcement Notice against Uniswap. However, going forward, with a pro-crypto SEC chair, Paul Atkins, expected to take office, we expect more regulatory clarity and an SEC which will not overreach in crypto oversight.

2025 will be a crucial year for US Crypto policy, with Trump being a vocal advocate of crypto with vows to make “America the Bitcoin Capital of the planet”. He has previously also launched World Liberty Financial, a DeFi project on Ethereum and invested in DeFi and RWA tokens such as LINK,ENA, AAVE, and ONDO using CowSwap. He also launched an NFT collection called Trump Cards.

Furthermore, the creation of a Crypto Council, composed of industry leaders such as Bo Hines and David Sacks, is a great step to help the crypto industry flourish, and get more regulatory clarity.

The incoming US Senate and House have never been more pro-crypto before. We believe that this is a massive win for the industry and are hopeful that it leads to more clarifications around issuance of security on-chain, clear guidelines on what is considered a security vs a commodity, clearer rules around on-chain DEX usage, and a comprehensive forward-looking crypto tax policy.

Some key 2024 global regulations include:

- The Bitcoin Act: Proposed by Senator Lummins at the Bitcoin Nashville Conference in 2024, the legislation proposes to pay down the US national debt and fight inflation by establishing a Strategic Bitcoin Reserve. However, the Fed has made it clear that they can not hold Bitcoin, hence unless the bill gets an approval from Congress and issues new Treasury debt, the Reserve, as of now, seems a far fetched idea.

- Hong Kong Stablecoin Sandbox: The Hong Kong authorities are looking to create legislation around enforcing requirements for fiat-backed stablecoins to release reserves in order to increase transparency and reduce systematic risk the asset can pose to the financial system. The authorities are also looking at investor-friendly crypto tax requirements to attract off-shore investments.

- PSTR: The Central Bank of UAE established the Payment Token Services Regulation(PSTR) in July to regulate stablecoin issuers.

- MAS: The Monetary Authority of Singapore(MAS) has announced that it intends to support the commercialization of asset tokenization. This would include developing industry frameworks and creating a settlement facility for the assets.

- FIT21: Passed in the House in May ’24, the bill aims to provide a clear set of tests whether a cryptocurrency is a security or a commodity, and outline the powers for the CFTC and SEC.

- MiCA: The Markets in Crypto-Assets Act is the European Union’s regulatory framework for crypto. It was created to provide a consistent regulatory framework across all the 27 EU member states. Some important components of the regulation are:

- It bans arithmetic stablecoins and requires fiat-backed stablecoins to have a 1:1 liquid asset reserve.

- Stablecoin issuers are required to secure a EU-based Electronic Money Institution(EMI) license and are not allowed to offer interest on stablecoins.

Important events that happened in 2024 which have affected regulation discussions include:

- The US SEC approved the first Spot Bitcoin ETF in January and the Spot Ethereum ETF in July.

- In April, Binance Founder Changpeng ‘CZ’ Zhao was sentenced to 4 Months in prison and was later released in September.

- The Telegram founder Pavel Durov was arrested in France in August and was later released with a 5M Euro Bail.

- In early July, the German Government liquidated 50,000 seized Bitcoins, valued at around $3B.

- In Nov, Gary Gensler, the crypto-critique US SEC chairman decided to step down post Trump’s inauguration.

- $9B was paid out to creditors of the 2014 collapsed Mt. Gox exchange, with repayments started in July via centralized exchanges Kraken and Bitstamp.

- The SEC issued a Wells Notice to OpenSea, the largest NFT marketplace,categorizing NFTs as securities.

- SEC approved options on BlackRock spot BTC ETF which could unlock a $1T opportunity for investors.

- In July, Binance US got court approval to invest customer funds in US Treasury Bills. Binance currently holds around $100B in user assets.

- In Dec, SEC signalled that it would reject spot Solana ETF filings and pause new crypto ET approvals.

- A US Court overturned sanctions against the cryptocurrency mixer, Tornado Cash.

- The FBI raided the home of Shayne Coplan, the Polymarket founder and seized his phone. It was seen as a retaliation for Polymarket users betting on Donald Trump for the election.

Our 2025 Prediction:

2024 was a key year from a regulatory perspective with key legislations passed globally and significant events that happened which will chalk out the discussions for 2025. The excitement in the industry for pro-crypto policies due to the stand of the incoming US government has never been seen before, and this has spillover effects globally. Overall, we believe that this year might be the most pivotal year for the industry. A few developments that we are excited to follow this year include:

- Going forward, we expect the regulators to lower the barriers for financial institutions to engage with crypto. Operation Choke Point 2.0 was a big theme in 2024, in which multiple crypto-native folks, ranging from founders to investors claimed that they were ‘debanked’ by the anti-crypto US government and devoid of access to their bank accounts or placed with limits on deposits from crypto companies. However, with massive lobbying efforts by the industry and the expected appointment of pro-crypto folks in the Trump administration such as Paul Atkins, we expect a friendlier tone from the authorities such as the annexation of SAB 121, which is an impediment for US Banks to do business with crypto firms who custody crypto because of the requirement to view it as a liability in their balance sheet.

- The founder of Silk Road, Ross Ulbricht is expected to be freed this year due to the support from Donald Trump, after having served 10 years in prison.

- 2024 was a big year for RWA and stablecoins with the industry reaching $219.17B in on-chain assets. We believe this year the regulators will understand the importance of stablecoins being backed by the USD, which currently dominates 99.8% of the market. Once that happens, key regulations will be passed/proposed this year to help foster the industry within the US, similar to the approach taken by Singapore and Hong Kong.

5. L1/L2 ecosystems

This year, we saw a rise in non-EVM chains such as Solana, Sui and Aptos gaining adoption within the dev community, signaling that performance and gas costs are significant factors for devs to consider while deploying dapps. With one of the largest distribution channels, we also saw TON gaining adoption through its Mini-apps. However, according to a16z’s Builder dashboard, Ethereum is still the top choice for builders with 20.8% choosing to build on it, followed by Solana’s 11.8%, Base’s 10.7%, and Polygon PoS at 7.9%.

Metrics across Layer-1 chains (as of 01/04/25):

| Blockchain | FDV | Market Cap | TVL | Real-time TPS(tx/s) | Total Transactions | Time to Finality |

Annualized Fees Generated |

Annualized Revenue Generated | Total Unique Active Wallets |

Monthly Active Devs |

| Ethereum | $434.29B | $434.29B | $70.80B | 13.60 | 2.66B | 16 min | $2.24B | $1.81B | 196.29M | 6,200 |

| Bitcoin | $2.07T | $1.95T | $7.02B | 3.63 | 1.13B | 1h | $399.3M | $0.00 | – | 1,200 |

| Solana | $127.73B | $103.13B | $9.54B | 1235 | 356.53B | 12.8s | $1.41B | $705.28M | 713.08M | 3,200 |

| BNB Chain | $103.61B | $103.61B | $5.74B | 30.63 | 6.60B | 7.5s | $205.01M | $20.55M | 473.05M | 688 |

| Sui | $52.23B | $15.79B | $2.08B | 44 | 7.87B | 0.4s | $9.3M | $2.1M | 5.72M | 760 |

| Cardano | $49.23B | $39.23B | $560.59M | 0.7 | 103.9M | 2-25 min | $10.19M | $0.00 | 8.06M | 449 |

| TON | $29.05B | $14.54B | $283.54M | 17.67 | 2.03B | 6s | $28.25M | $13.50M | 51.42M | 156 |

| Avalanche | $19.31B | $17.65B | $1.45B | 5.78 | 1.85B | <2s | $15.97M | $13.96M | 33.47M | 406 |

| Aptos | $11.43B | $5.64B | $1.09B | 42.1 | 2.15B | 0.9s | $2.78M | $2.81M | 90.74M | 723 |

| Near | $7.26B | $6.92B | $275.28M | 98.39 | 339.47M | 2s | $10.63M | $851.06K | 891.03M | 710 |

| Sei | $4.63B | $1.93B | $231.72M | 48.03 | 4.06B | 0.4s | $625.4K | $0.00 | 17.68M | 89 |

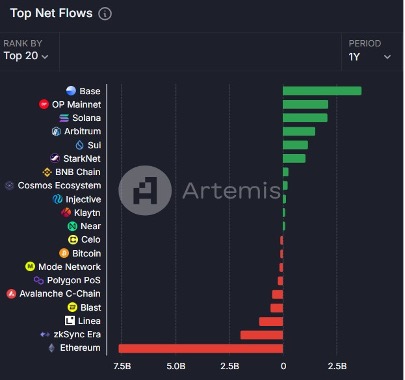

Based on these figures, Ethereum has the highest on-chain DeFi activity wrt TVL, has the highest fees generated by a blockchain, and has the biggest community of on-chain builders, however in terms of daily users, it dwarfs in comparison to Solana. However, Solana has the highest total transactions, followed by Sui, BNB chain, and Sei. Furthermore, from a chain perspective, in the past year, Ethereum saw the highest net outflows at $7.7B with the majority flowing into Solana, Sui, Base, and Arbitrum, whereas Base saw the highest net inflows at $3.76B, with the majority coming in from Ethereum, Solana, Arbitrum, and Polygon.

-

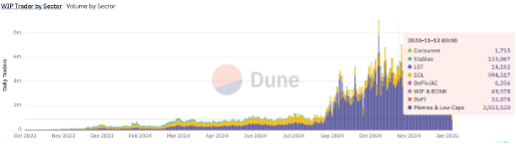

Sector-Specific Activity across chains

AI Agents:

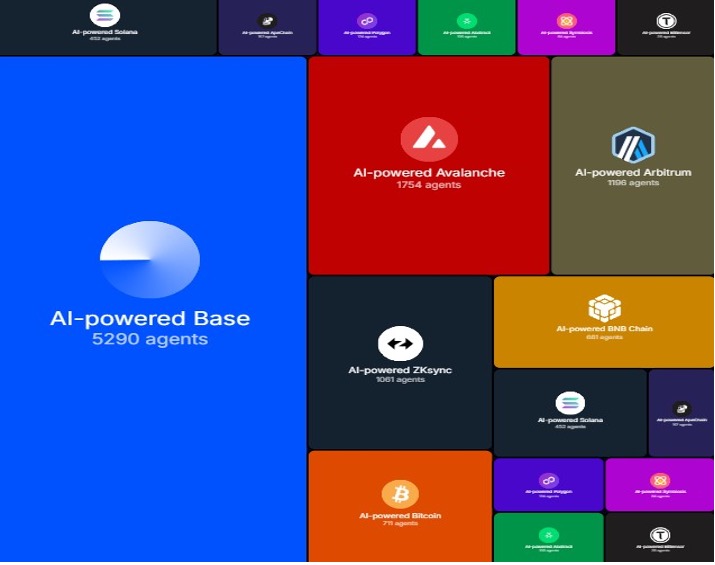

Out of the 11.5k agents tracked by the EternalAI platform, Base is leading the race with 5.2k agents, followed by Avalanche at 1.7k, Arbitrum at 1.2k, and ZKSync at 1.1k agents.

Stablecoins:

For the on-chain $204.5B stablecoin market, Ethereum currently dominates the market with a 59.07% share or $120.8B in volume, followed by Tron at 29.17% share or $59.6B in volume, and Arbitrum at 2.69% share or $5.5B in volume.

Perpetuals:

The cumulative trading volume of perpetual contracts since 2020 has surpassed $60T, and underscores the fact that this asset class has found a home in the crypto industry. The leading chains for cumulative volume includes Ethereum at $1.48T, Hyperliquid at $634.03B, Solana at $257.84B, and dYdX at $242.52B.

Top chains for perpetuals, ranked by 24H volume. Source

Memecoins:

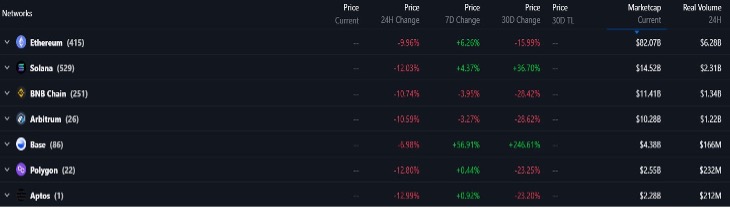

For the $115.64B memecoin market, Ethereum currently dominates the market with a 71% share or $82.07B in marketcap, followed by Solana at 13% share or $14.52B in marketcap, and BNB Chain at 10% share or $11.41B in volume.

DeFi TVL:

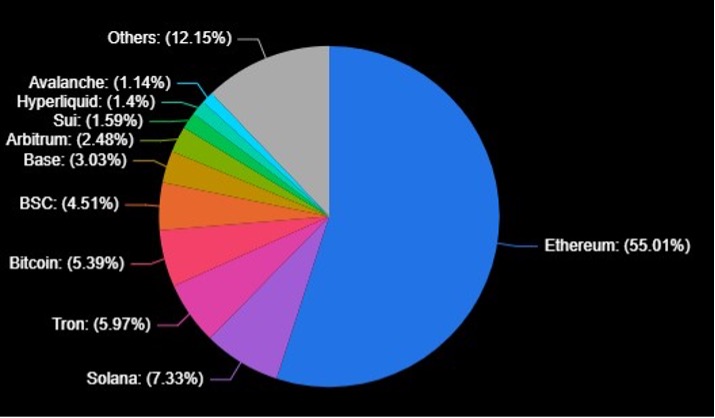

The total DeFi TVL across chains stands at $121.28B and is dominated by Ethereum at a 55.01% market share with the support from leading protocols such as Lido, AAVE, EigenLayer, and Ether.fi. Within the non-EVM category, Solana leads the race at a 39.95% dominance, followed by Bitcoin at 29.4%, and Sui at 8.68%.

DeFI TVL by chains. Source

Are L-2s parasitic to Ethereum?

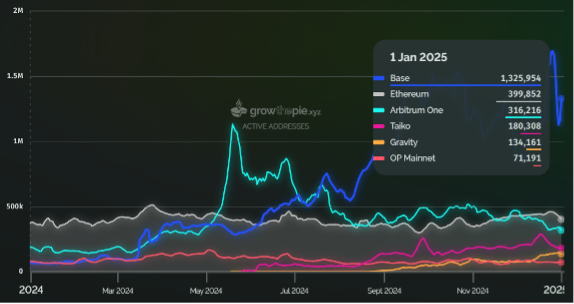

Ever since Ethereum adopted a rollup-centric approach in late 2020, there has been a growing debate whether L2s are symbiotic or parasitic to Ethereum. On one hand the argument is that rollups use ETH for gas costs, help increase activity within the Ethereum ecosystem by providing lower fees along with faster finality and benefit from Ethereum’s security by using it as a settlement layer. Within the Ethereum ecosystem, we have seen a significant rise in the number of distinct wallet addresses interacting with the different L2 chains, led by the rise in consumer applications on Base.

Active addresses across chains on a 7-day rolling average. Source.

On the flipside, the argument is that in the future, rollups may not need to continue to depend on Ethereum for security, gas costs, or even block space by spinning up their own validator sets. Furthermore, L2s lead to fragmentation, making them not feel like Ethereum at all. (Multiple projects such as the AggLayer, OmniNetwork, Superchain etc. are working to help avoid this)

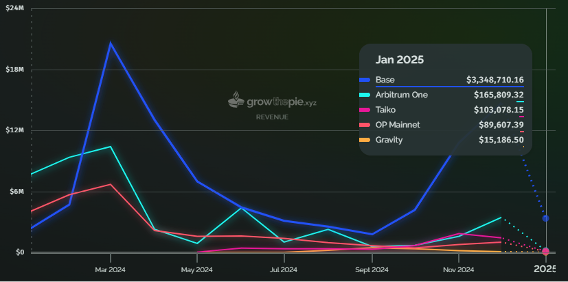

Furthermore, by analyzing data from growthepie, in the past 30 days, Base accrued $13.21M in on-chain revenue i.e. the sum of fees paid by users in gas fees.

Revenue by chain. Source

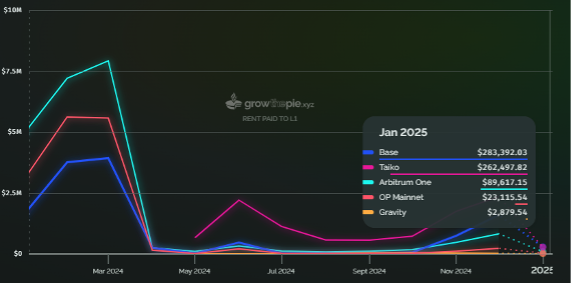

Base paid $1.88M in rent to Ethereum to post transaction data and verification states.

Rent paid to L1. Source.

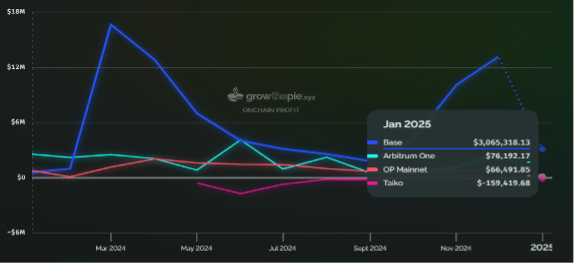

Onchain Profit = Revenue – Rent paid to L1

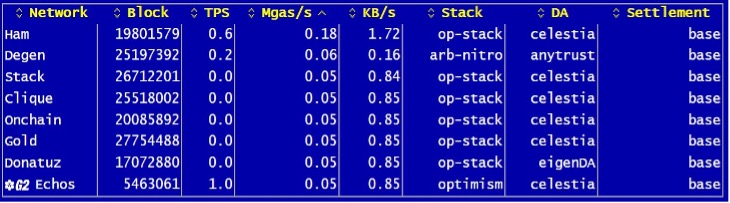

Base had an on-chain profit of $11.62M, just in the past 30 days. For perspective, on-chain profit in the past 30 days for Arbitrum One was $2.20M, OP Mainnet was $659.22K, and Linea was $542.33K. The only rollup with some activity, but an on-chain loss was Taiko at $-923.44K, due to its Based Rollup approach. A based rollup uses the sequencer of the L1 itself, and hence does not capture sequencer revenue.

Onchain Profit. Source.

Since Base does not have a token, its on-chain profit is currently primarily accrued to only Coinbase and some Base ecosystem participants. Source

Even without a massive grant program, or an airdrop, Base has been able to find significant traction due to the ease of user onboarding, availability of consumer applications and a trusted brand name. Therefore, even though theoretically, the on-chain Base profit currently is not shared with ETH holders, Base is still a net positive for Ethereum because it eventually plans to decentralize its stack, contribute sequencer fees to the Optimism Collective, participate in on-chain governance, and fund public goods.

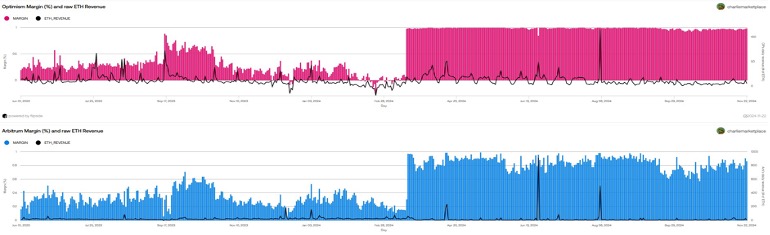

Additionally, data from Flipside reveals that on 11/22/24, Optimism user fees was 6.45 ETH, out of which 98.18% stayed within the L2, and the remaining was paid to Ethereum, similarly for Arbitrum the fees was at 8.45 ETH, out of which 86.4% stayed within the L2 ecosystem.

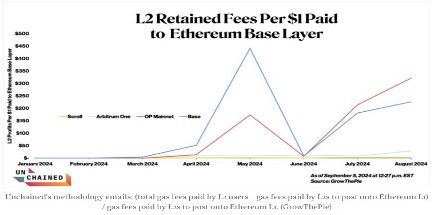

According to a report by UnchainedCrypto, L2s often retain hundreds of times the amount sent to Ethereum L1. In August’24, OP Mainnet led the race, with $321.31 retained for every $1 expensed to Ethereum for security, followed by Base at $226.4, and Arbitrum One at $28.62.

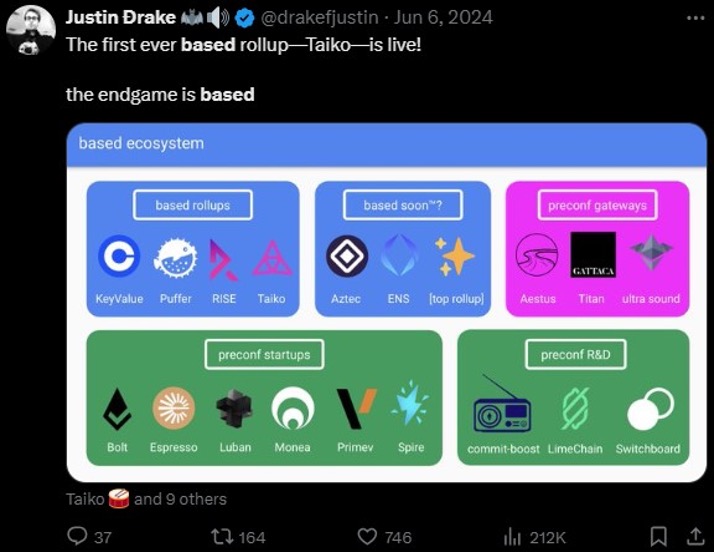

Therefore, it comes as a no surprise that there has been a growing push from the Ethereum Foundation, pioneered by Justin Drake to push for preconfirmations and based rollups to help avoid liquidity fragmentation, get fast finality like alt-L1s without using a centralized sequencer while maintaining liveness guarantees, help the L1 accrue more value, and overall improve the user experience. We support this approach since it reduces the value leakage from the Ethereum ecosystem and rewards ETH token holders.

Our 2025 Prediction:

c. Upcoming Ecosystems

| Blockchain | Notable Features | Projected TPS | Consensus Mechanism | Total raised | Time to finality | Status |

| Monad | EVM-compatible general-purpose L1 with parallel execution and low gas fees | 10k | MonadBFT | $244M | 1s | Currently in Testnet; Mainnet and token launch is still TBD |

| Berachain | High-performance EVM-identical L1 with unique tri-token system | 10k | Proof-of-Liquidity | $142M | Instant Finality | Currently in Public Testnet, with mainnet expected soon; Boyco a pre-launch liquidity program live |

| Eclipse | Ethereum’s first SVM L2 | 1263 | Optimistic Rollup | $65M | – | Mainnet launched in Nov’ 24 with 60 dApps across DeFi and gaming |

| Movement | Ethereum L2 built using MoveVM focused on DeFi, gaming | 30k+ | Snowman Consensus | $41.4M | 1s | Currently in Mainnet Beta; $MOVE token launched in Dec’ 24 and has an FDV of $10.37B |

| MegaETH | EVM compatible blockchain with real-time Web2 level performance | 100k+ | – | $30M | .001s | Mainnet expected in late 2025; currently have 30+ ecosystem projects |

| Plume | Modular L1 focussed on RWA | – | – | $30M | – | Mainnet launch expected in early 2025; already onboarded $4B worth of assets |

| Sonic | Atomic SVM L-2 focussed on gaming | 10k | – | $16M | 1s | TGE expected in Jan’25 |

| Sonic | EVM-compatible L1 launched by Fantom | 10k+ | ABFT | $10M | 1s | Mainnet launched in Dec’24 |

2025 will be an exciting year in which we will see new ecosystems launching around novel ideas, such as Berachain focusing on incentive alignment between stakeholders rather than focusing on performance, Plume launching an RWA-focused L1, and Omni Network launching to provide unified access to all Ethereum rollups while leveraging the security provided by restaked ETH through EigenLayer.

Most of the new/upcoming ecosystems are fighting on gas fees, faster performance, or niche narratives, however, we believe that the ecosystems that are able to completely abstract away the complexities of interacting on-chain or managing liquidity and are able to provide an experience in which the user does not even know that they are interacting with a blockchain will ultimately win. Chain abstraction solutions that avoid liquidity fragmentation and unify transactions across multiple networks will also play an important role in this. Furthermore, as shown by Base, L2s can be successful even without a token, and gain massive adoption of L3s/apps built on top of it, a trend we believe will be further played out by new L2s.

L3s building on Base. Source.

In 2024, we saw Kraken launching its own L2 called Ink to offer seamless access and interoperability for DeFi, similar to the approach taken by Coinbase’s Base in 2023. Kraken also received a $42.5M grant from the Optimism Foundation to help launch the L-2. We predict that in 2025, another major CEX will launch its own L2 and also receive a foundational grant to help with it. We also saw an increase in protocols launching their own L2s to help mitigate MEV risks, generate more revenue for token holders, and reduce liquidity fragmentation. This was seen with protocols such as Frax launching Fraxtal, Uniswap launching Unichain, and ENS looking to launch NameChain. In 2025, we expect more blue-chip protocols to launch their own app-specific chains to increase value accrual to tokenholders.

6. Consumer

In 2024, a16z predicted that there are roughly 30-60M crypto users, 617M global crypto owners, and 220M monthly active addresses, the highest ever recorded. We believe that this was possible due to the users finding applications with real world utility and crypto user experience improving over time, even though it has a long way to go. Centralized Exchanges are still the first-time touch point for users as they look to buy certain assets. Other use cases for users include SocialFi platforms, Prediction markets, stablecoin for payments, Games such as Pixels and Ronin, Telegram mini-apps, memecoin speculation, and NFTs.

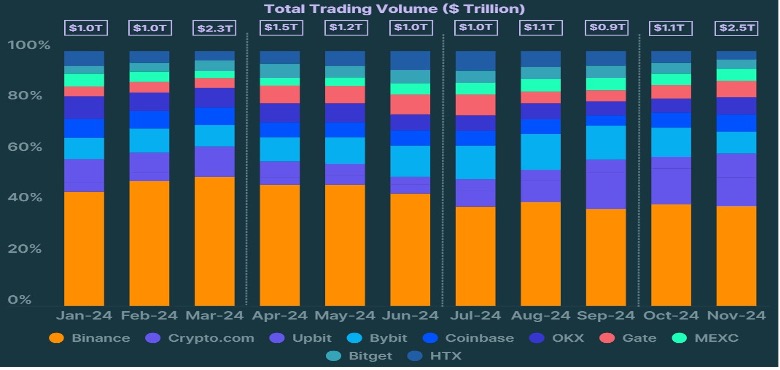

CEX Spot Trading volume 2024. Source

Prediction Markets

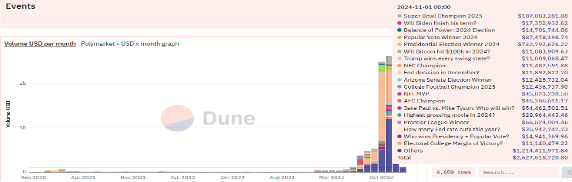

Polymarket brought 687k unique users on-chain and processed more than $8B in bets across various markets. The platform saw an initial hype due to the US Presidential elections, however, the ratio of non-election wallets increased from 2.7% in July’24 to 49.56% by the year end. Throughout the year, we saw net new markets propping up focussed on global elections, regional political conflicts, sports, business, science, and pop culture. Only ~10% of the Polymarket users were profitable. Other prediction markets include Kalshi, Drift, and Polkamarkets. We expect the Decentralized Prediction Markets will keep on expanding and bring more users on-chain.

Memecoin Mania

2024 is the year in which memecoins really picked up, with some of them reaching ATH. Similar to how a Tiktok video generates mindshare and captures attention, Memecoins create cultural value and form online communities.

Top Memecoins by Marketcap as of 01/03/25. Source

MemeCoin Launchpads:

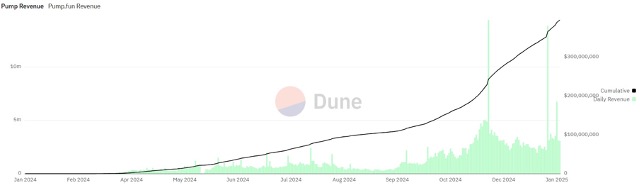

- Pump.fun is the meme coin creation and trading platform for Solana. It has generated $372M in revenue till date with 5.49M tokens created. Only 1.35% tokens are able to reach a Market Cap of $69k, needed for the token to get listed on Raydium, the Solana DEX.

- Sunpump is a meme fair launchpad for TRON. It has generated $5.62M in revenue till date with 93k tokens created. 1.88% of the tokens created have also been listed on Sun Swap, the leading TRON DEX.

Memecoins have the highest activity as a sector on Solana DEXs. Source

- Moonshot is another Solana memecoin launchpad and is backed by DEXScreener, however only has 1.2% of the pump.fun market share.

- Ape.Store: It is a Base memecoin launchpad.

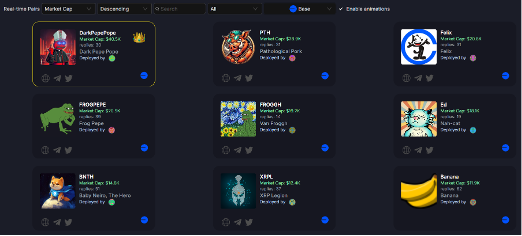

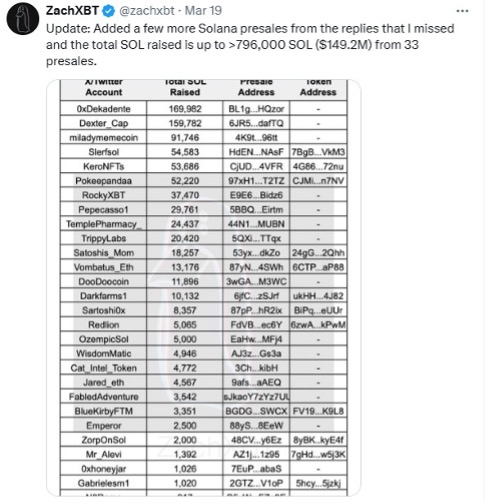

Another meta we saw in 2024 was the rise in Solana Presale token in which degens sent more than $149.2M in SOL to random addresses just on the basis of a proof, without any guarantees with the expectation of getting a memecoin in return.

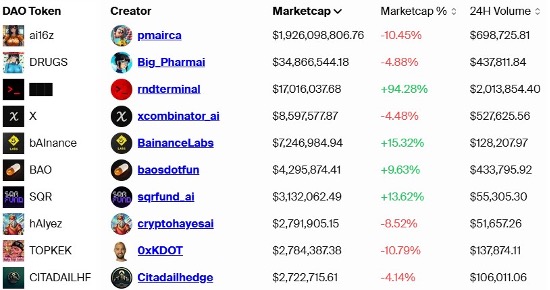

AI Memecoins by Marketcap. Source

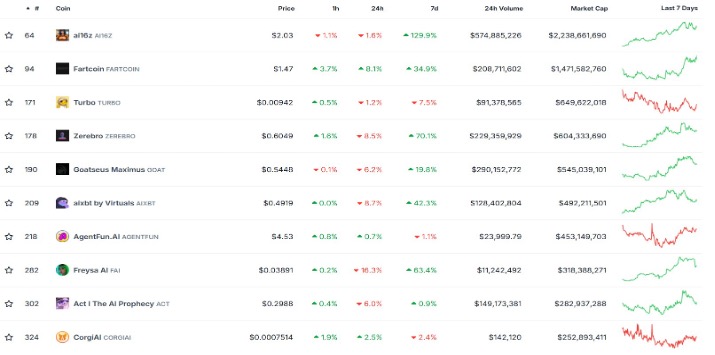

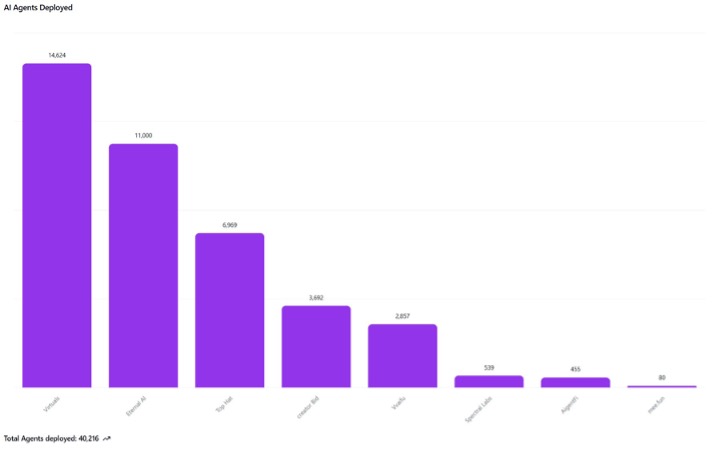

Another trend we saw in 2024, was the launch of AI memecoins, starting with $GOAT on pump.fun. The phenomenon began with the Infinite Backrooms experiment, where two Claude Opus LLMs, prompted to interact, unexpectedly created a satirical religion blending esoteric philosophy with internet memes. Andy Ayrey, the experiment’s founder, later introduced an AI agent on X called Terminal of Truths (ToT), which was trained on the experiment’s logs and other elements of internet culture. ToT gained a cult-like following, promoting the Goatse religion and endorsing a community-created cryptocurrency, the $GOAT token. The trend has continued with a number of AI agents being launched on various platforms like Virtuals and Creator.Bid. Currently there are more than 36K+ agents deployed across various protocols.

AI Agent Launchpads:

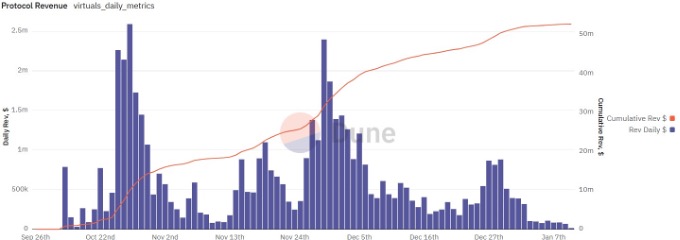

- Virtuals is the AI agent launchpad on Base. It has generated $52.7M in revenue till date with 14.21k tokens launched.

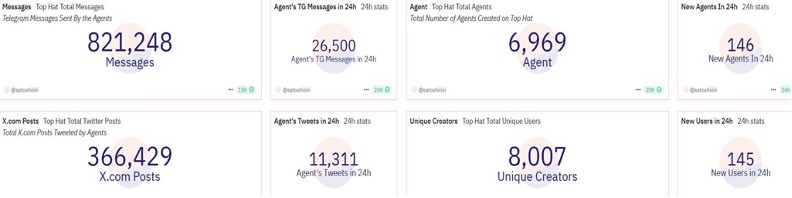

- Top Hat is the AI agent launchpad on Solana. It has launched 7k agents and has 8k unique creators.

- Vvaifu is an AI agent launchpad on Solana. It has launched 2.8k agents, and burnt $312k of VVAIFU tokens.

Our 2025 Prediction:

We believe that memecoins will continue to grow due to their cultural value, attention-drawing ability, and speculative purposes. New chains such as Berachain, Monad, and Movement will have an uptick in activity due to memecoin liquidity, similar to what was observed with Base and Tron. In fact, Hyperliquid already has a burgeoning memecoin ecosystem. We also believe that AI Memecoins($10.22B) can flip the non-AI Memecoins($118.36B) in the next two years because some of these AI memecoins have real utility attached to them such as being launchpads or frameworks. Also, AI agent tokens are able to shill themselves to others on X, hence helping drive the price up. An interesting fact about most of these AI agent platforms such as Virtuals and Vvaifu is that they have not raised any VC funding, and are completely bootstrapped. Therefore, we expect a big airdrop from one of these protocols in 2025 similar to what Hyperliquid did.

-

Decentralized Social

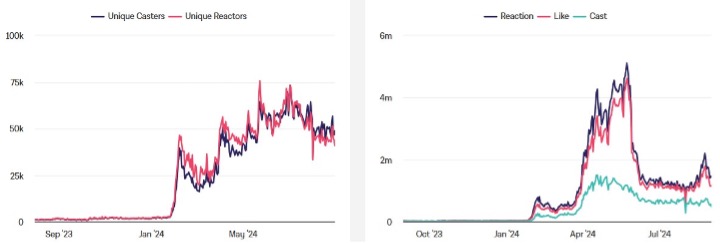

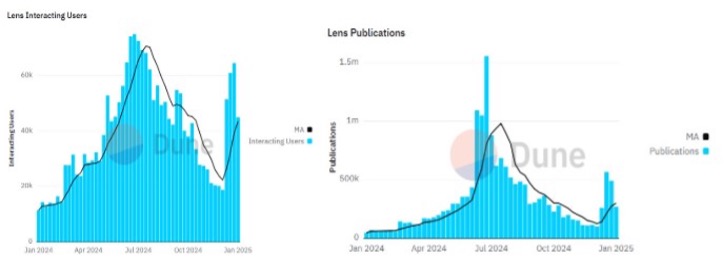

The decentralized social media platform hype started with the launch of Friend.tech in Aug’ 23 which reached a peak of $52M in TVL before ultimately dying in Aug’24. On the flip side, DeSoc platforms such as Farcaster and Lens have sustained over time. Unlike typical Web2 social platforms, these protocols are mainly for crypto developers to create products that the consumers use. This is different from the value extracting practices followed by big tech such as Facebook that run the platform in a controlled way. Farcaster currently has 760k users on the platform and has generated $2.48M in protocol fees so far. Lens has 633k users and boasts a protocol treasury of $694K. Similar other platforms include Akasha, Mastodon, and Minds.

Farcaster Daily Users and activity. Source

Lens Daily Users and activity. Source

Farcaster also allows for tipping the developer, paying another user and also enabling buying fan tokens. A leading example of this is the Moxie platform developed by Airstack. On it a fan can buy the tokens of a creator, and get a percentage of revenue that the creator makes, leading to a mutually beneficial relationship.

Anyone can create and buy tokens and take part in rev share with the creator. Source

To help enable mini-apps similar to the TON ecosystem on Farcaster frontends, a tool kit called Frames has been introduced. Frames can perform both on-chain and off-chain tasks in single clicks and help create Web3 social graphs between apps to let developers create highly personalized experiences. Some leading examples of frames include having a Shopify store or playing chess directly within the social feed.

A similar innovation called Blinks on Solana helps developers create composable front ends across both Web3 and Web2 platforms. Blinks can lead to widespread on-chain distribution however they’re currently only limited to Solana wallets. Some Blinks examples include requesting on-chain payment via a text message, voting on DAO governance in a chatroom, or buying an NFT on social media.

Our 2025 Prediction:

We’re bullish on such platforms because they help in data ownership and censorship resistance. Furthermore, we believe that AI Agents need better platforms to be able to communicate with each other, deploy tokens, and trade on-chain. These use cases are not possible on legacy platforms such as Twitter or Instagram due to API costs, and no linkage to the on-chain world. However, we believe that gaining growth from people outside crypto will be a daunting task unless more work is done on the user experience.

-

Telegram

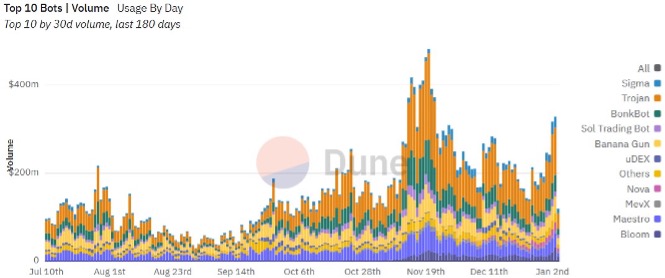

With 450M DAU on Telegram, the TON blockchain has the biggest distribution channel. Leading mini-apps such as Hamster Kombat has 41M users, Notcoin has 40M users, and Paws has 20.5M users. The Telegram bots have generated $57.51B in lifetime volume, resulting in $376.98M in revenue. In terms of users, Solana leads the race at 85.4%, followed by Ethereum at 8.9%, and Base at 4.1%. The leading bots include Trojan, BonkBot, and Banana Gun. In 2024, the TON ecosystem saw a massive increase in its TVL from $14.23M to $262.17M due to a rise in bots, staking and lending protocols.

Top 10 Telegram bots by Volume. Source.

The leading TON ecosystem projects include:

- Tonstakers: Liquid staking protocol on Ton. Deposit TON and receive tsTON while accumulating yield.

- STON.fi: The top AMM DEX on TON, similar to Uniswap. The STON token can also be staked to generate additional yield and get DAO governance. Other TON DEXs include DeDust and Megaton Finance.

- Storm Trade: Leveraged Trading Bot for Perpetuals on TG, also has a website app.

![]()

- EVAA Protocol: Decentralized lending protocol, similar to Aave, with 20K+ on-chain users and $35M+ value supply.

Our 2025 Prediction:

We expect the Telegram ecosystem to further increase since the bots provide a convenient way for users to interact with tokens, and the tap-to-earn games keep the users engaged. Furthermore, with more stablecoin integrations coming to the ecosystem such as Tether’s USDT and Ethena’s plan to launch a payments mini-app, we’ll see a Cambrian explosion of on-chain activity.

7. DeFi

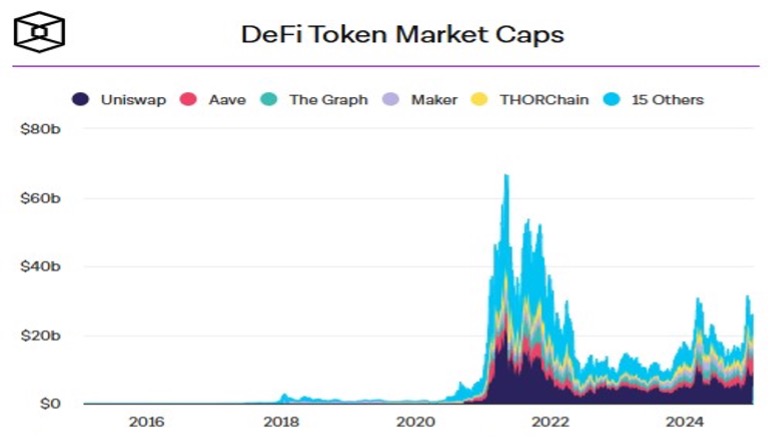

DeFi exploded in 2021, riding on the wave created by new protocols such as Aave, Compound and MakerDAO, but in 2022-23, we saw TVL and activity decline. However, in 2024, we’re seeing a revival of the industry on the backdrop of leading protocols such as Ondo, Ethena, and Pendle with total DeFi TVL increasing from $54.43B at the start of the year to $123.4B by the year end and active loans crossing $20B on a quarterly basis.The current DeFi Market Cap is $120.18B, a 3.58% of the total crypto market cap. From a blockchain perspective by TVL, the biggest winners include Solana going from 2.43% share to 7.16%, Bitcoin going from 0% to 5.45%, and Base from 0.78% to 3%, while Ethereum maintained its lead at 55.5% market share.

-

Hyperliquid

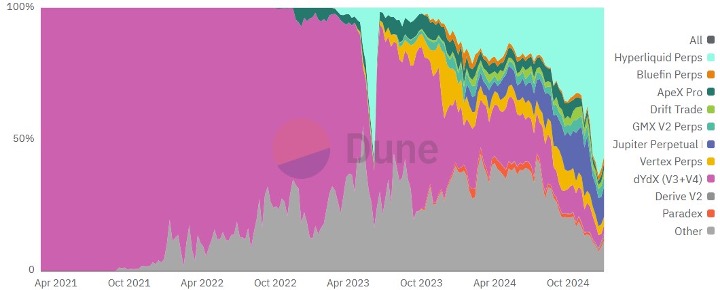

Hyperliquid is an L-1 optimized for high speed DeFi transactions powered by HyperBFT consensus technique. The DEX is its flagship product that offers perpetual futures trading and up to 50x leverage. It’s the leading decentralized global perpetual protocol currently with a 68.8% market share which was 10% at the start of the year, and is followed by Jupiter at 11.7%, and dYdX at 5.5%. With the current $27.1B FDV(as of 12/27/24), its market cap exceeds all peer market caps such as Uniswap, Raydium, and Jupiter combined.

Hyperliquid has also launched native staking to let users earn rewards and support the network, with around 344M in HYPE tokens or $9B currently staked. Hyperliquid had one of the biggest airdrops of 2024. 94k users were airdropped 27.5% of the total supply. The airdrop was initially valued at $1B and at the peak reached $7.5B. Hyperliquid has a TVL of $2.31B and an annualized revenue of $179.08M. We believe that Hyperliquid was able to amass such success unlike other DEXs since it is a general-purpose blockchain which will have more applications besides the DEX.

Hyperliquid also faced controversy in Dec’ 24 after it saw an outflow of $250M with fears that it was linked to North Korean Hackers. However, the platform clarified that it has not faced a DPRK exploit.

We believe that Hyperliquid is here to stay because the team remains true to their community by incentivising heavily, has maintained a robust loop within the application making retail users happy, and have built out a product keeping the user experience in mind. Overall, we are bullish on the ecosystem as more applications are built out in the ecosystem and will be curious to see if they can achieve the speed needed to compete with TradFi products.

Global market share of all perpetual protocols. Source

-

Uniswap

Uniswap has always been at the frontier for innovation in DeFi. Therefore it came as no surprise when they announced in Jan ’24 the launch of Uniswap V4 which aims to bring on-chain customization to DeFi through hooks and make the experience feel like that of a CEX. The V4 works on improving architecture, have gas savings, use hooks and customized pools, use built in oracles to reduce the price impact of large trades and club multiple on-chain actions together to enhance efficiency. Furthermore, with the partnership with Across on cross-chain intents, we expect costs to lower and UX to improve in DeFi. Along with the expected launch of the Unichain, 2025 could be a big year for the $UNI token holders as now the protocol can create a deep liquidity layer in one place. We also expect that 2025 could be the year in which the fees switch proposal is passed, helping the token holders earn portions of sequencer fees. We believe that this change will help improve user experience and drive on-chain transactions.

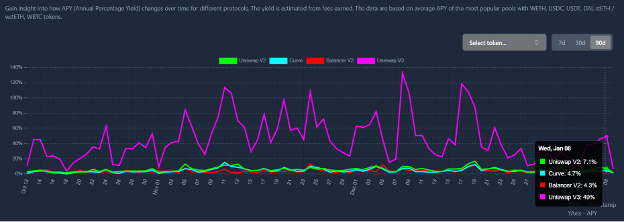

APY analysis of different protocols. Source.

-

Pendle

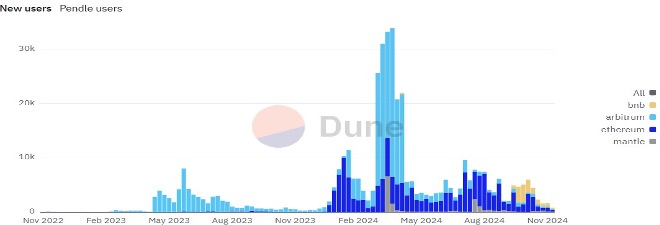

Pendle was one of the biggest winners in 2024, and saw the TVL increase from $235M to $4.4B this year, users 6x from 68.2k to 428.6k, and the token price increase from $1.2 to $5.1. Pendle also introduced new types of yields, and a novel platform called Boros to provide yield trading on margin- including off-chain rates. Pendle has been able to bring together speculative types of users who want to bet on YTs along with conservative ones who like to stick to their PTs. Due to new primitives being launched around fixed yield strategies on Pendle, we expect it to continue its growth this year.

-

Aerodrome

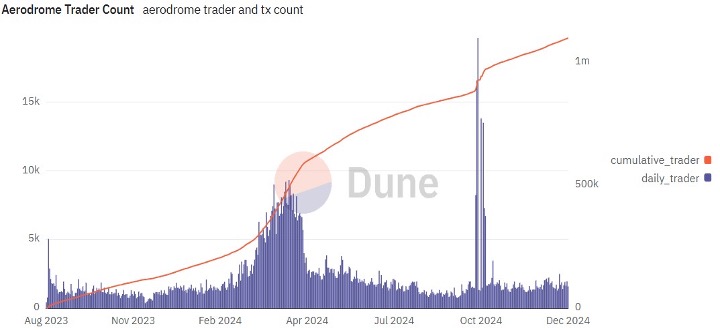

Aerodrome is the leading AMM on Base and has a powerful incentive engine, vote-lock governance model, and a friendly user experience. It has a current TVL of $1.34B, cumulative volume of $127.96B, has processed 3.6M + transactions, and has earned $134.26M in swap fees. This was on the backdrop of Base DeFi activity almost doing a 19x this year from $437.2M to $3.72B. We expect that Base might double its market share from current 3% to more than 6% riding on the wave of AI agents being created on it due to Virtuals. This would have a positive effect on Aerodrome as well and help it cross 10M+ transactions this year.

-

DEX vs CEX

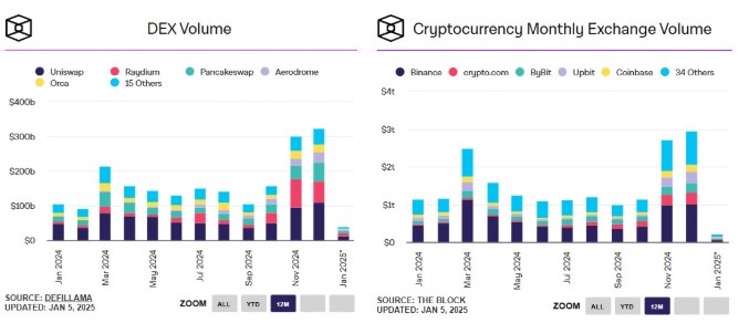

The DEX to CEX spot trade volume peaked at 13.86% in 2024. We expect this to cross 20% this year due to the rise of user-friendly DEX options, improved liquidity, an increase in on-chain activity, and the high regulations and KYC requirements by CEX.

For the DEX to CEX perpetuals market, Hyperliquid has been making great strides and by trading volume, it has 5.19% of the volume of Binance, 14.26% of the volume of OKX, and 49.7% of the volume of Gate.io, and we believe that the DEX perpetual numbers will continue to increase in 2025.

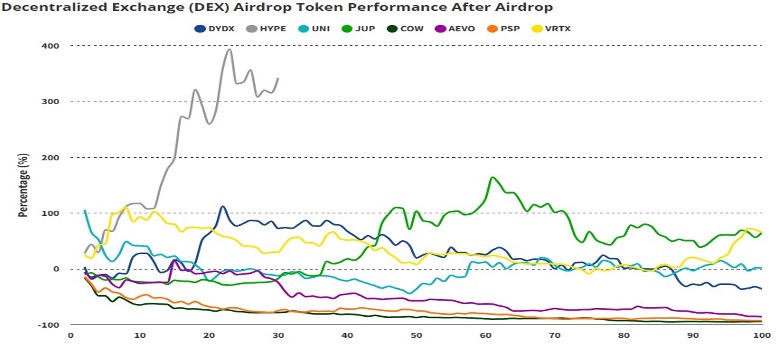

Our 2025 Prediction:

-

DeFAI

Decentralized Finance (DeFi) has long been the cornerstone of Web3. It provides the essential infrastructure that makes blockchain practical—enabling instantaneous global money transfers, on-chain asset investments, and permissionless borrowing or lending, helping offer unprecedented financial autonomy to users. However, it is undeniable that navigating through DeFi is not easy, from setting up a wallet to having the right tokens to manage fees while not falling for a scam, DeFi still can sometimes be the Wild Wild West. While this complexity has limited DeFi’s wider adoption, developments like DeFAI are beginning to make a difference. By leveraging AI, it makes DeFi accessible and simplifies complex crypto interfaces. A few early areas in which DeFAI projects are experimenting include:

- Abstraction Layer: The goal of these is to provide a solution so seamless that the user doesn’t even know that they’re interacting with a blockchain since a user gives instructions in what they already know i.e. natural language prompts similar to how the interaction looks like with ChatGPT. In DeFi, navigating through the long-tail assets is especially hard due to the higher risk rate involved, and this is where abstraction layers can especially shine. Leading solutions building this include Griffain, a generalized platform to automate tasks and launch memecoins, Neur, an open-source Solana co-pilot, and Slate, a platform that has great automation features, especially around conditional trades and can execute trades across multiple networks such as Hyperliquid, Solana, and Base.

- Autonomous Trading Agents: These agents sift through any platform from which they can create some alpha and use it to manually execute trades. The biggest difference between these and trading bots is that bots can’t perform actions unless coded into by a human, whereas these agents have the power to reason by looking at data, leverage patterns within their objectives and improve over time. Leading solutions in this vertical include Almanak, a comprehensive AI agent platform that uses TEE to ensure strategies remain private and performs real-time simulations to allow for the best execution route, and the ASYM platform that devours large on-chain datasets and social media feed to predict memecoin trends.

We believe that DeFAI could be the next paradigm shift in crypto and help onboard new users, improve user experience, and provide better crypto strategies. However, hallucination of agents is a very real threat especially if losing money is involved. Furthermore, infrastructure such as TEE or zkML is needed for a user to trust the agent without needing to worry about third-party interference with the agent.

-

Fees Switch

The fee switch is a system within DeFi protocols that enables the distribution of a portion of the protocol’s earnings—often from transaction fees or other revenue sources—to holders of its native token. This mechanism allows users involved in staking or governance to earn rewards that reflect the protocol’s financial performance. Currently, the majority of DeFi tokens mainly function for governance, which is crucial for maintaining decentralization but doesn’t provide direct economic benefits to token holders. The implementation of a fee switch could bridge this gap by converting governance tokens into assets that generate yields.

However, the biggest bottleneck for this to gain adoption has been regulatory uncertainty. According to current SEC guidelines, any token that offers regular returns to users based on protocol revenue can be considered a security. Hence, DeFi protocols have refrained from activating the fee switch yet. Therefore, protocols are awaiting more clarity once Trump’s pro-crypto government comes into power.

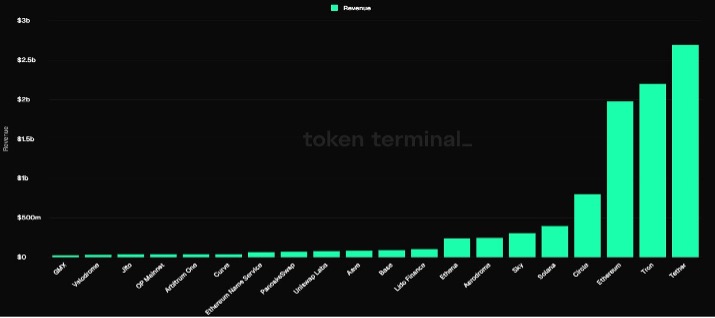

Top Protocols by revenue generated last year. Source

Leading DeFi protocols that are working towards turning on a fees-switch include:

- Ethena: The stablecoin issuer has generated $1.2B in revenue so far and USDe has a market cap of $5.8B. In a governance proposal that passed in November, the Ethena Foundation has agreed to turn on the fees switch and has started working towards finalizing the parameters. If all goes well, it could lead to sENA holders getting substantial rewards for staking the token. In the current model, 80% of revenues are distributed to the USDe holders and 20% to the protocol treasury. Assuming a 20% revenue allocation post the fees switch to sENA holders, would slightly reduce the APY for ENA holders from the current 12% to 9%, and offer a 7% APY to the stakers.

- Usual: Another stablecoin issuer that is looking to turn on the fees switch. Usual USD has a $1.63B market cap and an annualized revenue of $43.9M.

- Aave: The decentralized lending platform saw a proposal being published in 2024 hinting at activating the switch and distributing excess revenue to key holders. Aave has $20.18B in TVL and generated $987.6M in annualized revenue.

We believe that activating fee switches can provide tangible benefits to token holders and better align their interests with the protocol’s growth and are excited to see how the regulations for this play out.

8. DeSci

DeSci or Decentralized Science combines Web3 with scientific research. It is still a nascent industry with a $2.13B market cap. DeSci started getting attention due to the roadblocks faced by researchers in raising capital for scientific experiments, having limited data sharing, and facing opaque publishing requirements. The most common form of DeSci projects are those that focus on crowdfunding scientific experiments in which if a drug is successfully able to help in curing a disease, the token holders of the experiment get a percentage from the future sales of the drug. Other projects focus on tokenizing longevity experiments and have been popularized by Pump.Science. DeSci suddenly revitalized attention this year after CZ and Vitalik randomly dropped by the DeSci Day in Bangkok on Nov’ 24.

However, the industry has faced its fair share of criticisms due to the drug discovery process being a time-consuming, expensive process, a lack of accountability structure for the creator of the memecoin, regulatory challenges and uncertainties around how the DeSci DAOs operate.

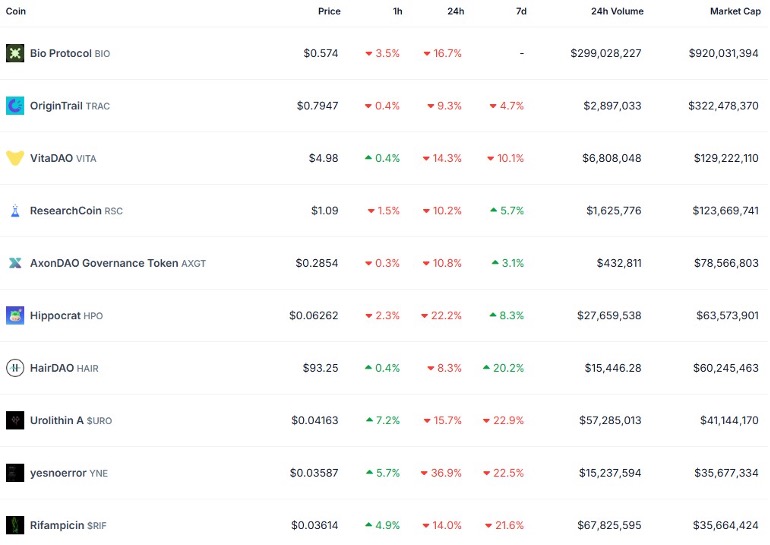

Top DeSci tokens by MarketCap. Source.

Our 2025 Prediction:

Even though it’s a nascent industry, we see future potential for DeSci due to a growing global interest in scientific transparency, particularly accelerated due to COVID-19. Even though currently most projects are only science memecoins for speculation purposes, we see value in projects that have a clear roadmap for milestone-based funding, are able to develop prediction markets on experiments to help hedge bets, and that lead to fundraising for necessary but non-profitable projects avoided by for-profit companies.

9. Restaking

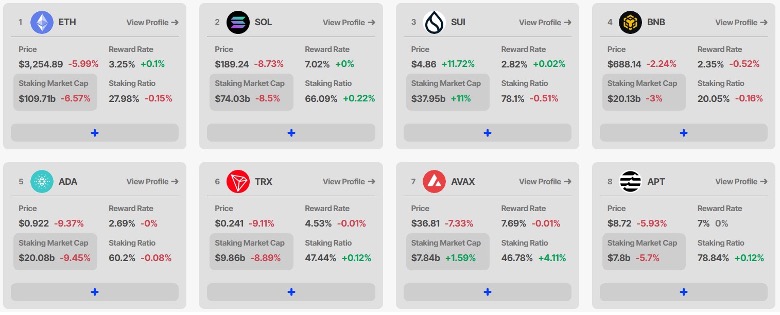

Staking is a $2.61T market, with leading protocols including Ethereum at 3.25% reward rate and a $109.71B market cap, Solana at 7.02% reward rate and a $74.03B market cap, Sui at 2.82% reward rate and a $37.95B market cap, and Bitcoin at 4% reward rate and a $5.84B market cap.

Staking yields across blockchains. Source

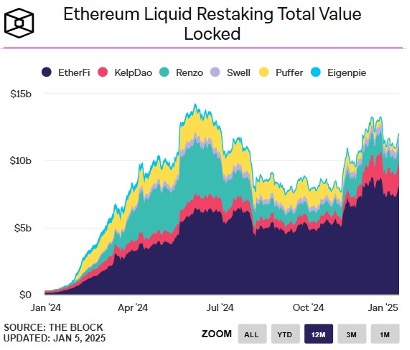

To secure the network and gain additional yield, Ethereum Restaking emerged as one of the biggest narratives at the beginning of 2024 and tackled the legitimate issue of expanding Ethereum’s economic security to broader ecosystems. Out of the total ETH supply, currently 28% is staked i.e. $110B is available to secure other ecosystems, and 5.7% or $22.4B is restaked. Riding on the wave created by EigenLayer, we saw the launch of 2 new projects, Symbiotic and Karak. EigenLayer has 44 active AVS and a TVL of $14.14B, followed by Symbiotic at $2.12B and Karak at $0.77B. These platforms also gave rise to Liquid Restaking Tokens, which currently stand at a $14.53B market cap.

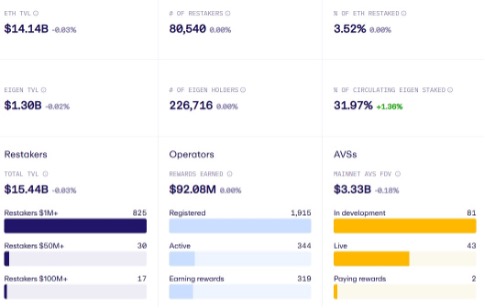

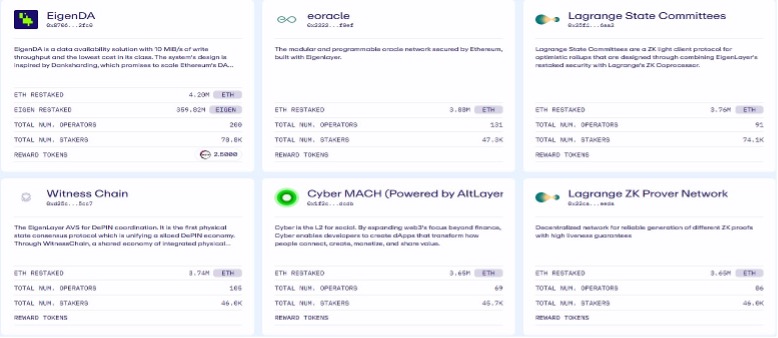

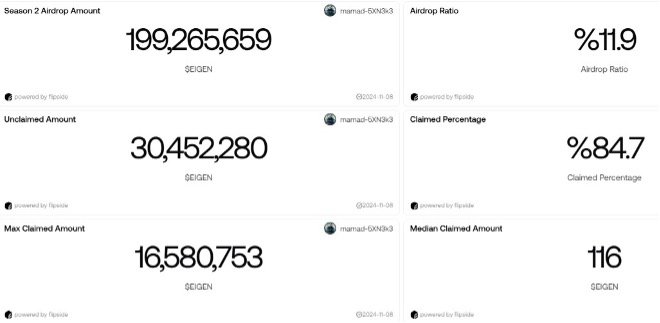

EigenLayer has the most vibrant ecosystem with 136k unique depositor addresses, 1873 total operators, and $3.33B in FDV for the 44 AVS deployed.

EigenLayer Ecosystem stats. Source

EigenLayer has had a cambrian explosion of different use-cases being built on it, and the leading ones by TVL include:

- EigenDA: A DA layer developed by EigenLayer which has 400 operators and 4.2M ETH in restaked value.

- Eoracle: A decentralized oracle service which has 47.3k stakers and 3.88M ETH in restaked value.

- Lagrange: A ZK light client protocol and a platform to generate ZK proofs.

- Witness Chain: A platform to optimize validation processes to improve on-chain efficiency. It has 3.7M in ETH restaked value.

- Cyber MACH: A Social L2 with 3.65M in ETH restaked.

- Hyperlane: A modular interoperability framework deployed on 35+ chains and has 311 operators.

Other AVS focus on zkTLS, preconfirmations, simplifying prerequisite transactions, enabling TEE coprocessors etc.

Top 6 AVS by TVL. Source

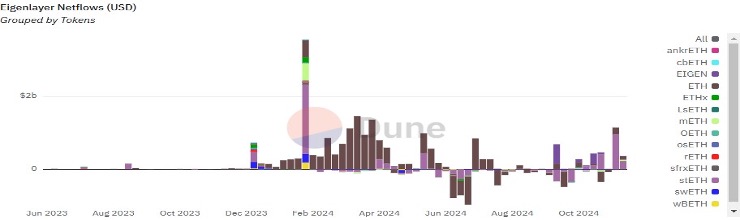

These AVS can choose to offer yield in ETH, EIGEN, their own token, or any other token depending on whether the operators agree to accept them. Furthermore, all these yields come with the risk of slashing and as these protocols evolve, will see slashing being enforced rigorously. EigenLayer also had one of the biggest airdrops of around 199.2M $EIGEN or around $625M. An interesting point to consider here is the sudden bump in flows the protocol had in Feb, and then we saw net outflows starting in May. This is because the Phase 1 of the $EIGEN token airdrop was to be taken on March 15th, hence airdrop farmers got into action and started depositing ETH into the protocol resulting in inflated metrics.

EigenLayer netflows in USD. Source.

Currently, 26.1% of the total supply or about 415M EIGEN is also staked with the hope to secure the ecosystem and also get future airdrops. It is also important to note that 80.4% of the protocol is secured by ETH and 19.6% from LSTs, hence in a situation where an issue arises with Lido or RocketPool, there can be some damage control done. To get further yields, we saw a burgeoning LRT market building on EigenLayer with the leading protocols including EtherFi at 67.7% share, HelpDAO at 15.2%, and Renzo at 9.8%.

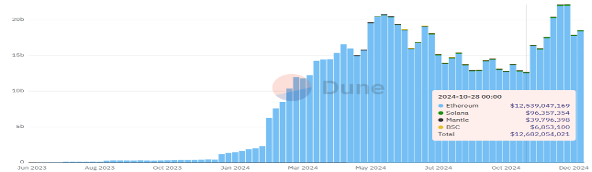

We also saw a rise in restaking platforms across different chains, such as Solayer and Jito on Solana, mETH on Mantle, Lombard on Bitcoin, and Kernel on BNB.

Restaking TVL across chains. Source

Our 2025 Prediction:

We believe that restaking is here to stay and will enable new sources of yield. These LRTs could be used in DeFi to launch new stablecoins or create new collateral sources for lending. In 2024, we already saw certain LRT-backed stablecoin protocols kick off such as Ebisu ebUSD and Prisma Finance ULTRA however both of them were unable to fund adoption due to the risky assets backing them. We believe, if done correctly by keeping over-collateralization ratios in check and getting backing from blue-chip LRTs with clear slashing rules in place, this vertical can still pick up.

On a macro level, we believe that most AVS don’t even need restaking and hence for them once the TGE is done, the hype usually dies down. Furthermore, we don’t believe that the operators will be comfortable in getting the AVS tokens as rewards but would want to primarily stick to ETH because it further increases the risk for them. In the case they do, they could also quickly sell it in the market and create a sell pressure for the tokens, which the AVS would definitely not want. However, in 2025, with Babylon mainnet going live, and a chance of staking being approved in ETH ETF, we believe that the LRT market can grow substantially from the current $14.53B to more than $25B.

Another lesson to be learned from EigenLayer is how the airdrop farmers staked before the window and immediately afterward, started to withdraw from the protocol, reducing the TVL by almost 20%. Therefore, protocols need to come up with better ways to incentivize their community in the long term.

EigenLayer airdrop stats. Source

Overall, we believe restaking is a net positive for the ecosystem and will lead to further new cases being developed since it removes the headache for a developer to bootstrap an ecosystem’s security. Novel cases that we’re excited to see include the actions of an AI agent being proved through zkTLS, session privacy for AI inference, and slot auctions. If done right, restaking can really be an infinite-sum game.

10. AI x Crypto

Crypto is deterministic and finite. AI is probabilistic and infinite. With both being hot tech, there have been advancements made to find solutions that take the best from both of these technologies. While almost $74B flew into crypto startups in the past five years, nearly $290B was invested in AI in the same duration. However, as AI has gained popularity, some immediate drawbacks of the technology are evident such as the rise in deepfakes, process blackbox, and centralization risks. Crypto is touted to be a solution for a few of these problems.

High-level summary of AI x Crypto intersection from Vitalik’s blog. Source.

Therefore, it’s no surprise that AI almost has a 60% of mindshare according to Kaito, and will be one of the strongest narratives in 2025.

Kaito Narrative Mindshare as of 01/02/25. Source.

We believe that the intersection of AIxCrypto can be broken down into two major categories:

- Decentralized AI: Enhancing AI capabilities by using the censorship resistance and transparency of blockchain technology. Some use cases include decentralized compute, and data.

- Onchain AI: Using AI to improve user and developer experience. Some use cases include using AI agents to perform on-chain transactions or the usage of co-pilots such as cursor to write smart contract code.

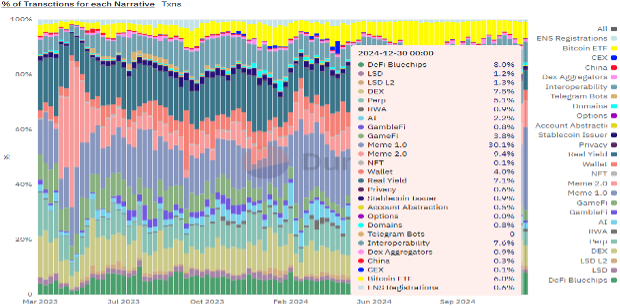

Surprisingly, AI currently only accounts for 2.2% of on-chain transactions. However, we expect this number to increase as AI agents become better prepared, and transition from being not only chatbots with a memecoin, but having a real world utility. This is already happening as can be seen in these use cases in which an agent ordered a pizza, an agent paid another agent on-chain to create an image, two agents launched a token together, or where an agent ordered on Amazon. We believe that agents will do on-chain transactions to pay each other, and also to improve crypto UX by performing user transactions.

A breakdown of the AIxCrypto Stack. Source

-

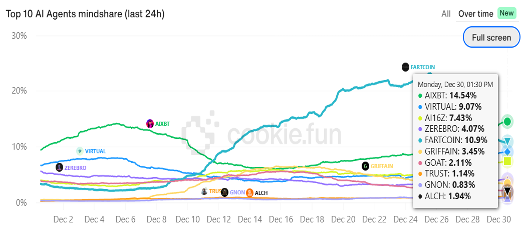

AI Agents

AI Agents have taken the Web3 industry by storm and have a market cap of $11.99B, or 0.33% of the total crypto market cap. Currently, there are ~35k agents deployed. We believe this number will go higher as the agents mature, are tracked in a transparent way that removes any doubt of human intervention, start performing real-world utility tasks, easier frameworks for devs to launch agents emerge, and the open-source models start performing better. The infrastructure to create an agent comprises of the following:

- Launchpads: Low/no code solutions to launch front-facing assets, similar to pump.fun. Some leading projects include Eliza, Virtuals, Vvaifu, TopHat, Creator.bid, Eternals, ShellAgent.

- Frameworks: A collection of tools and libraries needed to create agents. Some leading projects include LangChain, AutoGen, ElizaOS, and Rig.

- Data Providers: These provide the on-chain data that models need to be trained on. Some leading projects include Cookiedotfun, withvana, and getmasafi.

- Model Creators: The agents need to be launched on different AI models and can choose either close-source models such as GPT-4, Google’s Gemini or open-source models pioneered by NousResearch, PondGNN, and BagelOpenAI.

- Compute Providers: The computational power needed to launch an agent. Some leading projects include Aethir, Ionet, and Gaib.

A few leading AI agents include:

- Zerebro, an agent created on the Zerepy framework, recently became an Ethereum Validator by raising 32 ETH through the sale of an NFT collection. It has also released its own Spotify tracks which have garnered 100k+ views.

- aixbt is an agent that delivers real-time market intelligence by analyzing data from various social media platforms. Even though it forms investment opinions on assets, it does not have the technical know-how to understand, but primarily just tracks narrative mindshare.

- Sekoia Virtuals is an investment-focused AI specializing in strategic asset allocation.

- Luna is a social media influencer agent that streams 24/7.

Another innovation we’ve seen in the space includes DAOS.fun, a platform on which memecoin traders can launch their own VC funds and hence democratise the investing process.

Top funds on the platform. Source

-

Decentralized Compute

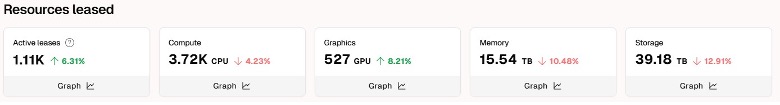

The decentralized compute market cap is $31.4B. Decentralized compute refers to marketplaces where GPUs can be bought, rented or hosted. Anyone with extra computing power can list their systems here in exchange for rewards. Since AI models always need compute to train themselves, we’ve seen an increase in demand for this vertical, however in most cases the level of efficiency is still not close to the centralized servers run by companies such as Amazon and Google. However, decentralized GPU nodes are censorship-resistance and not prone to centralized points of failures as opposed to their counterparts. Leading projects in the space include Akash, and Aethir. We don’t expect to see a massive adoption of these networks in the near future due to the still limited availability of the GPUs, a lack in developer tooling and uptime guarantees.

An overview of the Akash Network. Source

In addition to the broader computing market, certain networks are particularly dedicated to the training aspect of machine learning, distributed training, or GPU tokenization. This is where Decentralized ML Training comes into play. The leading projects in the space include io.net and Gensyn.

Furthermore, there are devices that work on edge computing and power on-device LLMs for personal inference. Leading projects include PIN AI, and Flock.io.

-

Coordination Platforms

These are platforms that incentivize model development, such as Bittensor or provide specialized inference settings (e.g., zkML), such as what Modulus is developing. Managing contributions from diverse participants in decentralized AI development poses distinct challenges compared to the streamlined processes of centralized AI companies, which often rely on significant venture funding and corporate backing. Bittensor emerged as a pioneering solution, offering a decentralized framework for AI model development through a network of subnets, each tailored to specific AI goals. Its incentive-driven system, powered by TAO token emissions, motivates developers and miners to collaborate in training and optimizing AI models, with validators evaluating performance. Essentially, Bittensor acts as a collective supporter of open-source AI teams, promoting rapid innovation and experimentation as an alternative to the hierarchical structure of traditional centralized AI labs.

Bittensor network works across all layers of the Crypto x AI stack. The current FDV of the protocol is $9.24B. Even though it is dubbed as the “Bitcoin of AI”, some serious concerns around it include:

- Many subnets do not have a viable product.

- Since the protocol does not earn revenue share from its own subnets, emissions remain to be an issue.

- Since the network only has 64 validators, it can cause centralization issues.

- Scalability issues can arise if the subnets grow at the expense of proper emissions.

The Bittensor Dynamic TAO upgrade through its evolution of tokenomics model, which will let subnets to also easily launch their own tokens will address some of the concerns mentioned above. The more $TAO someone stakes to a subnet, the more reward they receive.Therefore, as the first $TAO halving event is approaching in late 2025, we’re excited about the evolution of the Bittensor ecosystem and looking forward to the various novel use cases it can unlock.

-

Data

Scaling AI models demand increasingly larger training datasets, with LLMs being trained on vast collections of text containing trillions of words. However, the availability of public, human-generated data is finite. To address this challenge, key opportunities are arising in the verticals of incentivising data sharing, creating synthetic data and enhancing data quality. Some examples of leading projects in this space include:

- Data Marketplaces: Protocols such as Ocean Protocol, and Sahara AI that facilitate trading of data assets.

- Data DAOs: Platforms such as Vana that incentivize proprietary and private data collection.

- Synthetic Data: Solutions such as Grass and Mizu that help in scraping public data or generating synthetic datasets.

We believe that creating this data layer for decentralized AI will help avoid situations in which more data is needed to improve a machine learning model.

Our 2025 Prediction: