The majority of 2023 saw a grueling bear market for the blockchain space. This has spurred developers to refine solutions rather than chasing hype cycles. This turbulent period has clarified that mainstream adoption requires overcoming usability and scalability barriers, exposed by recent volatility.

General market funding and innovation are focused on strengthening structural weaknesses – whether scaling existing networks via advances in zero-knowledge proofs or cultivating specialized blockchains purpose-built for specific applications rather than general protocols.

Looking ahead, it seems that 2024 is positioned to deploy these systemic solutions into production. We can expect rapid progress in confidential privacy preservation powered by upgrades to zero-knowledge technology and computing enclaves as well as enhancing user experience and security as users are used to in the “centralized/web2” world. Highly customized blockchains are demonstrating advantages for use cases, like AI/ML and digital identity.

Additional key trends include hardened security audits and testing tools that leverage recent exploit patterns, bringing real-world assets on-chain, simplifying interactions for less-technical users and developers.

The wide range of infrastructure building across specialized niches signals a continued effort to make blockchains usable for wider audiences, beyond just tech enthusiasts. Solutions profiled in this paper collectively convert obstacles highlighted in 2023 into opportunities for sustainable advancement.

Looking back to 2023

As we release our 2024 tech trend report, it’s worth reviewing some of the key projections made by us last year and how those forecasts played out.

On the crypto front, our report accurately identified declining VC investment, fallout from high-profile bankruptcies, and increased regulatory scrutiny as major 2023 themes. However, token prices and trading volumes rebounded somewhat in November 2023, exceeding the extent of contraction we predicted.

Regarding Web3, mainstream consumer traction proved slower than forecasted. However, NFT and metaverse gaming retained pockets of strength as cited in the report. The report was also on target regarding major tech players racing to build out metaverse capabilities and virtual worlds. However, challenges around interoperability and hardware adoption rates persisted.

In the world of decentralized finance, adoption of AML/KYC infrastructure, DEXs over CEXs, and fixed income projects fell short of ambitious forecasts due to uncertainty within the regulation space and a slower market. However, innovations such as cross-chain asset transfers and transmission networks have gained some traction and will continue to be in development throughout 2024.

Within the infrastructural predictions, the zkEVM has seen a lot of public attention. As many leading protocols in the zk space have attempted to implement the zkEVM, development was fierce and now the technology is almost ready for adoption. In addition, the rollup space has seen more development in the shared sequencers space which further incentivizes user adoption and decentralization for the L2 solution.

Overall our thematic framework held up reasonably well, while timelines around areas like metaverse maturation and DeFi advancement proved more ambitious than realistic. In any fast-moving space, tech forecasting requires constantly updating models and approaching exciting opportunities with measured skepticism. We carry these lessons into formulating our 2024 projections.

2024 Looking Ahead:

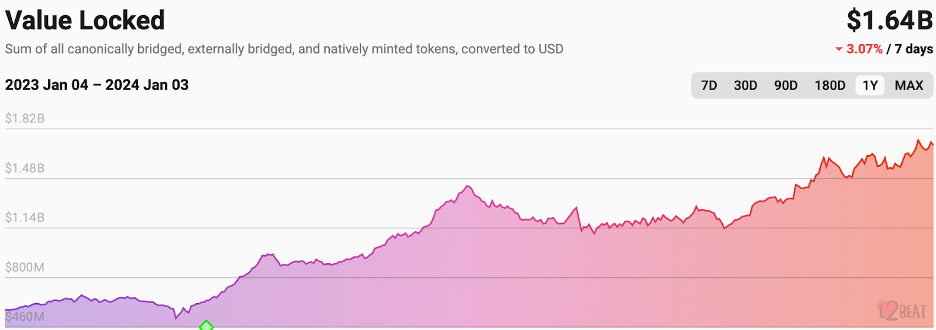

Further Advancements in ZK

Tangible confidential computing applications are reaching viability for everyday users, thanks to relentless innovation progressing zero-knowledge proofs over the past year. For instance, we see zkSync Era with $550M value locked, Linea with $181M value locked, or Starknet with $137M value locked to name a few. But what does this innovation trajectory look like for developers and consumers in 2024?

On the user side, novel use cases such as scalable execution of smart contracts via zkEVMs or running verifiable machine learning predictions through zkML protocols will become accessible to wider audiences. The value propositions around increased privacy protections, established credit systems/compliance, and reduced fees will compel gradual mainstream adoption despite some persistent user experience friction.

For developers, zones of innovation such as generalized zk virtual machines, privacy-centric layer 2 scaling solutions, and trusted execution environments (TEE) will be mature enough for building real-world apps. Teams are rapidly iterating to smooth APIs and integrations into existing infrastructure.

For example, a decentralized identity protocol may want to leverage zero-knowledge proofs to enable users to provably attest credentials like age or nationality without revealing the actual underlying personal details. This allows compliance without sacrificing privacy. However, crafting the complex zero-knowledge circuits to enable this credential verification innately makes development more difficult than typical smart contract coding. Factors such as proof generation times, transaction calldata size limits, and interface abstractions will constrain initial applications.

Specific bottlenecks include long proof generation latency, restricting use cases to only low frequency verification checks rather than real-time authentication. Also, current ZK transaction call data sizes exceed common blockchain limits like Ethereum’s calldata cap so applications require workarounds. Finally, the cryptography itself requires special abstracted development environments rather than mainstream solidity. So usability will trail traditional methods until zk languages and interfaces mature.

But continuous innovation across core circuits, infrastructure, and tooling will help mainstream adoption over time. We expect confidentially-oriented protocols to become viable for more applications through 2024 but likely still hampered by innate complexity obstacles.

Specialized Blockchains and Provenance

As blockchain adoption advances in 2024, we anticipate the emergence of increasingly specialized protocols designed for specific functions. This trend will give rise to more chains that are custom-optimized to cater to particular use cases, such as AI, ML, digital identity, DePin, and other verticals where specialized data availability layers are essential.

The ability to optimize performance, costs, and user experiences for niche domains, as opposed to generalized networks, will be a key driver for the adoption of these specialized blockchains. Interoperability frameworks will play a crucial role in connecting sovereign networks and integrating them into ecosystems. We anticipate a growing reliance on innovations like state proofs, data availability layers, and interoperability solutions that surfaced in 2023 to facilitate seamless communication. State proofs, for instance, enable verified off-chain computations to be utilized in online environments by generating a compact cryptographic proof certifying the results. Data availability layers offer options for reducing storage and bandwidth requirements between chains.

While there may be a potential for data mismatch with these technologies, the landscape of interoperability will mature in 2024, especially as more specialized modular chains are deployed in production. This growth will facilitate seamless communication between specialized sovereign networks and external blockchains.

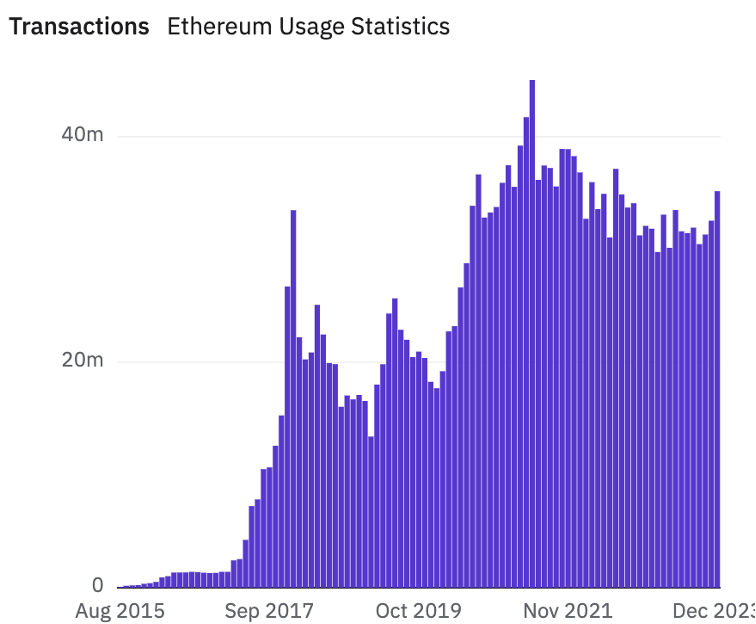

The proliferation of specialized chains actually fortifies Ethereum’s dominance as the underlying trust backbone. Settlement on Ethereum allows customized chains to inherit deeper credibility and security, improving decentralization. Rather than competing with Ethereum, specialized app chains optimized for functions like AI, ML, IoT and digital identity can reinforce it. We will likely see a net movement of activity and liquidity to L2 solutions rather than alternative L1s. Interoperability frameworks bridge sovereign specialized networks into an integrated ecosystem with Ethereum providing credibility and transaction finality guarantees. An early example can be seen through dydx v4 and their decision to move away from Starkware’s infrastructure. The ability to optimize performance and costs for niche domains while still connecting to Ethereum’s security will drive traction for this specialized chain model.

Ethereum connects the ecosystem by serving as the external data availability layer for many layer 2 and sidechain designs. It absorbs volume flowing across bridges. We also expect some existing base layer protocols to redirect emphasis to layer 2 scaling solutions relying on Ethereum’s security assurances, further centralizing its status. For instance, we see Polygon 2.0 creating the value layer that looks like the rest of the Internet.

Decentralized and shared sequencer models will aim to address scaling bottlenecks and single points of failure risks in layer 2 designs. As usage grows, exclusively relying on a solo sequencer becomes a risk from an operations standpoint. If the sequencer stops working, the entire layer 2 halts. This inspires solutions such as shared sequencers, which we see emerging projects such as Astria or Espresso systems which will see a lot of progress in technical and mechanical development in the next year, as well as tools such as Nodekit. Combined with data availability falling back on Ethereum, this provides decentralization both at the consensus and sequencing levels. The uphill battle will be balancing this distributed sequencing while retaining efficiency gains relative to the base layer.

These trends compounding Ethereum’s prominence will be reinforced by increasing institutional adoption preference for Ethereum as the settlement layer due to unparalleled liquidity and network effects from groups like Visa, Mastercard, SWIFT and others. However, in such a large scale customer base, there are ripple effects such as misinformation on chain, at the protocol level, or within off chain data lakes.

Thus, we will also see growing demand for provenance, metadata tagging, and verification tooling to authenticate digital artifacts and trace information flows back to trusted origins. The mainstream emergence of deepfakes and AI-generated media that are indistinguishable from reality will create an unprecedented accountability crisis. Specialized protocols focused on provenance, transparency, identity verification— and possibly proof of location leveraging decentralized IoT infrastructure down the line— will gain adoption to combat deception and falsified identities. Binding content directly to creator identities via blockchain can help address this pending scale of misinformation.

Security Testing Infrastructure

The blockchain industry witnessed several damaging exploits in 2023, including the $200 million Mixin Network breach and $197 million Euler Finance attack. But analyzing these incidents offers invaluable material to bolster security practices. For example, Multichain’s cross-chain drain of $126 million underscored risks in bridging assets across chains and the need for decentralized governance. And the $100 million Atomic Wallet compromise highlighted infrastructure vulnerabilities and potential for man-in-the-middle credential theft despite users having keys.

Recent exploits offer concrete examples to enhance protections against similar attacks across protocols managing pooled community assets. And audit tools can leverage reports to proactively flag theoretical weaknesses in additional networks sharing code with vulnerabilities.

The need for more rigorous security analysis extends rightly beyond simple bug bounty programs as the complexity of connected contracts directly handling user funds increases. Teams are wisening up to diversify testing from all angles before mainnet – from stress testing a wide array of edge cases, to large security competitions with millions in bounties, to using A.I to predict risks from code histories, and even to expert code reviews.

As historical cases accumulate, finely tuned observability models trained on past attack patterns could automatically highlight potential exploit vulnerabilities in code before mainnet deployment. For example, firms like Hexens (Delta portfolio company) provide comprehensive blockchain audit suites encompassing smart contracts, wallets, cryptography, and infrastructure reviews.

While hackers are incentivized to find flaws post-launch, teams can utilize all information afforded from past slips to make each wave of innovation safer than the last in a system strengthening itself.

Consumer Applications

Social Identity & User Analytics

The crypto industry recognized the need for enhanced user experience and intuitive developer tooling for mainstream adoption. After early growing pains, 2023 witnessed meaningful progress simplifying interactions which sets the stage for additional breakthroughs improving accessibility over 2024.

We expect further acceleration of customer-facing blockchain integrations by traditional businesses. Frontend experiences highlight features like airdrops, NFT rewards, and gated communities aligned to web3 models. As companies like Nike seek to leverage these mediums to engage audiences, packaged services reduce the integration barrier.

These trends strengthen the emergence of accountable social identities. Platform integrations provide observable participation footprints without sacrificing privacy. Analytics can relay insights on influence hierarchies, behavioral correlations to reputation scores, and other metrics informed by traceable yet pseudonymous contribution histories. Ethical oversight ensures transparency.

Equally, say cryptocurrency payments catch on for daily purchases like a morning bagel. Tracing this transparent commerce data will enable tailored insights for merchants, with confidentiality preserved via aggregation and anonymization rather than full exposure.

We expect new classes of blockchain-powered analytics for targeted advertising, contextual recommendations and other intelligence based on trackable participation rather than personal data exposure. Furthermore, consumer apps will drive mainstream traction; equally important are the tools emerging to understand movement within this new transparent but privatized online realm.

Abstracting Complexity through Tailored Automation Designs

Making blockchain apps focus on user intent hides tricky details behind the scenes. This makes apps easier to build and use. But it risks centralizing power into the private infrastructure enabling the abstraction.

Specifically, “intents” often rely on private relay servers to automatically execute transactions on the user’s behalf, such as Rhinestone.wtf. This avoids needing to handle network connections directly. However, transaction ordering and blockchain space are now controlled by that relay’s policies rather than transparent on-chain data.

A trend in 2023 that could potentially expand into 2024 is apps integrating proprietary bots, such as Unibot or BananaHQ, to snipe arbitrage opportunities around transaction fees or execution timing. While this auto-optimizes, the bots concentrate value extraction power within the app provider.

For example, an intent to send a payment could be padded with complex arbitrage orders alongside it. Executed privately off-chain, users would just see the end payment result, not the intermediate trades benefiting the app owner.

So while wrapping manual workflow steps into simplified intents dramatically improves user experience, it forfeits transparency into the private servers and proprietary algorithms now coordinating significant aspects behind the scenes.

The key will be ensuring modular architectures – allowing alternate relays – and progressive disclosure – showing execution previews – to retain user empowerment. Striking this balance will enable mainstream use without silently accruing centralization risks.

On-Chain & Off-Chain Indexing

Historically, retrieving and making sense of information directly from blockchains required building custom parsing and storage infrastructure given lack of indexing or querying capacities. This added overhead hampered rapid application development.

However, solutions have emerged to abstract these complexities for developers. Platforms like The Graph allow creating specialized subgraphs to track events and entities in near real-time across networks like Ethereum and Solana. Rather than raw chain scans, subgraphs structure data into easily accessible APIs.

Equally, specialized providers have emerged to offer targeted, decoded information streams tailored to particular verticals for example social and DeFi proucts. For example, Tokenflow provides structured datasets for on-chain analytics on factors like token circulation and contract activities. Airstack (Delta portfolio company) focuses on identity and reputation data indexing.

These tools unlock instant access to decoded, historical indexes filtered for precise developer needs. By handling the intricate data extraction and storage, they allow innovators to focus on high-value application logic rather than reinventing data pipelines. Additionally, the war of latency and reliability continues within technological developments, hardware data center wars continue to guarantee uptime. We expect sophisticated players coming into the space to infuse data into warehouses while observing continued growth in blockchain analytics services as adoption spreads across consumer and institutional markets.

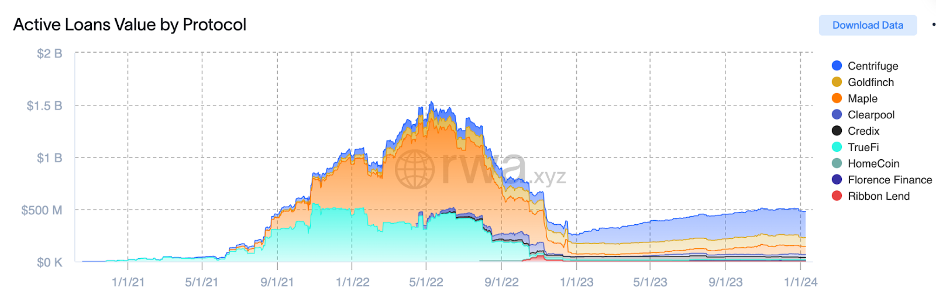

Evolution of DeFi

DeFi growth exploded in 2021, with leading protocols like Aave, Compound and MakerDAO managing over $10 billion in market size at peak. However, 2022-2023 saw declines in activity and TVL during the bear market. As the market matures, sustainable borrowing/lending focused platforms are likely to drive renewed adoption rather than hype-driven exaggeration. Real-world asset integration via stablecoins and transparent AML/KYC compliance infrastructure can spearhead the next wave of incremental DeFi traction among institutions.

LSTFi

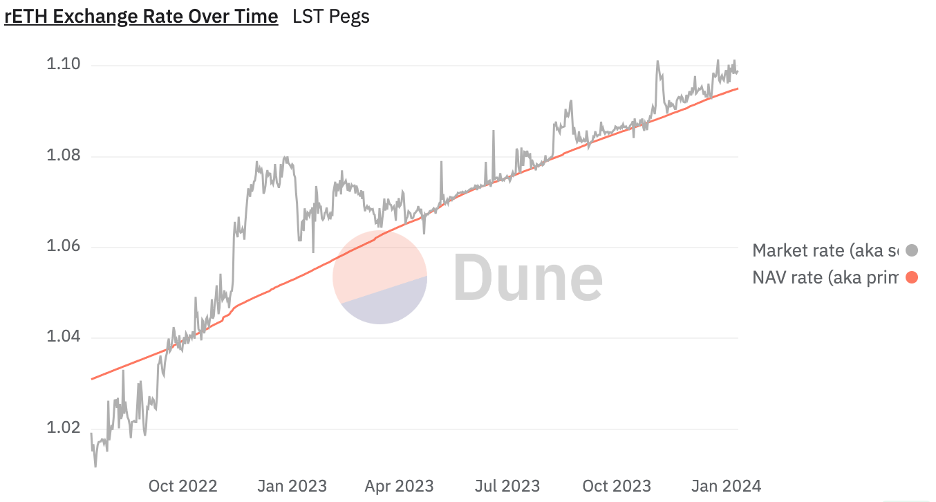

2023 saw explosive growth for liquid staked tokens (LSTs) like Lido’s stETH which unlocked Ethereum staking for DeFi apps without lockup periods. Protocols aggregating positions across LSTs like Origin Ether achieved trailing returns exceeding 6% APY.

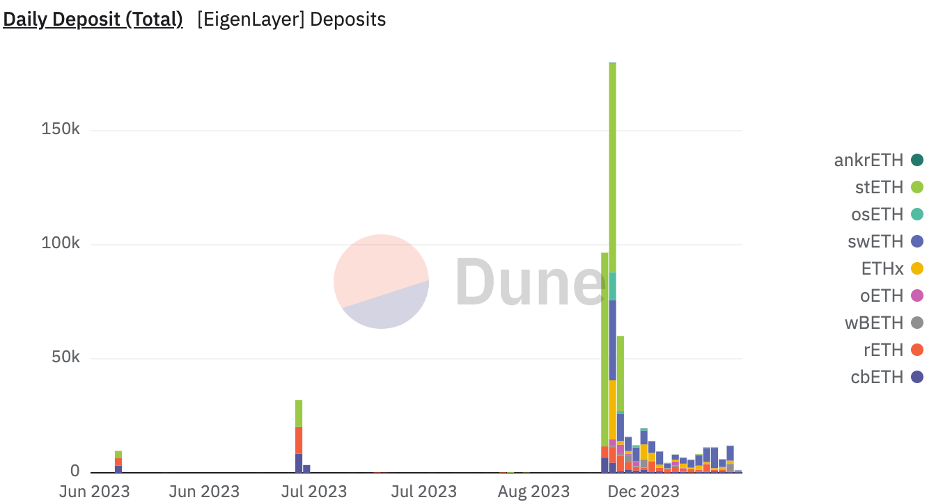

We expect the LSTFi sector to continue expanding in 2024 as new instruments allow fractionalization and composability while retaining staking yield. For example, Lybra Finance introduced interest-bearing stablecoins using LSTs as productive collateral. And EigenLayer’s novel tokenless restaking unlocks LSTs as productive collateral for developers building on emerging networks.

By sharing Ethereum’s security foundations, innovations like EigenLayer fortify newer chains and dApps through overcollateralized lending. This architecture enables permissionless innovation atop robust infrastructure, paving the way for more mature and developed LSTFi projects down the line in 2024.

DeFi Social Leaderboards

Crypto protocols pioneered a new model in 2023 – rewards programs allowing users to earn standings or “points” for certain activities. These points often hint at potential future token airdrops. In 2024, we expect personalized incentive schemes tying protocol rewards to individual user behavior to expand dramatically. Points unify quantified reputation with graded access to initial offerings.

Allowing protocols to direct specific behaviors – such as driving liquidity to new pools or exploring particular features – offers precision influence. Equally, staged rewards before formal tokens provide staged regulatory onramps. However, vague promises tied to pseudo-synthetic assets also risk overextending speculative timelines. Protocols will need to balance transparency in eventual payoff structures with flexibility for evolving business models.

Overall, the personalization of incentivization unlocks new levers for attracting early adopters in a crowded ecosystem. But sustainability will require managing expectations on trajectory conversion from ephemeral points to concrete payouts.

Tokenization of Real-World Assets

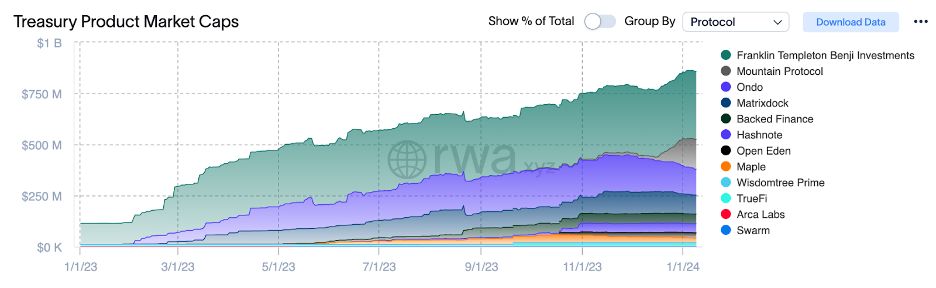

Bringing real-world assets like real estate, commodities and patents on-chain via tokenization into NFTs or other tokenomics mechanisms unlocks new programmable ownership potential. However, tangible assets have unique compliance needs versus natively digital crypto. Although the tokenization concept has been attempted previously, the collapse of unsustainable yield schemes in 2023 led to a resurgence of interest in connecting real-world assets to blockchain-based finance. We can see through rwa.xyz, a tokenized asset market intelligence company that the TLV in tokenized private credit has reached over $4.5 billion, and the total value in U.S Treasuries reached over $858 million.

The year 2023 saw increased regulatory guidance around asset tokenization, with the SEC outlining a path towards approving spot Bitcoin ETFs. The maturing compliance landscape encourages protocols to integrate features like on-chain identity, and transfer verification.

Many hybrid CeFi/DeFi projects bridging traditional finance into web3 will receive regulatory approval over 2024, vastly expanding asset tokenization. For example, we have seen SEC registration of robo-advisors focused on tokenized funds of real-world loans, such as those to small and medium enterprises (SMEs). Approvals like this pave the way for further tokenization of real-economy lending assets. Projects that strategically blend aspects of centralized and decentralized systems, such as combining DeFi structural advantages with compliance features like on-chain KYC verification, will gain more regulatory green lights over 2024. These approvals will unleash new categories of tokenized loan funds, using blockchain infrastructure but tailored to meet institutional compliance needs.

For example, Avalanche launched a $60M fund to accelerate asset tokenization by backing projects bringing real-world assets to its chain. As companies seek regulatory arbitrage opportunities, more traditional finance projects are likely to launch on layer 2 networks as well. Government and enterprise initiatives will also help catalyze innovation around blockchain-based ownership and rights.

Emergence of Staking 2.0

The multi-billion dollar proof-of-stake ecosystem witnessed continuous innovation in 2023 to increase capital efficiency, align incentives, and reduce risks for participants. These improvements set the stage for further advancements diversifying the possibilities for staking-derived yield and ownership in 2024.

Protocols like EigenLayer enable restaking positions to be unstaked without waiting for the lockup period to expire. Automated re-investment of assets back into validators without manual claiming improves compounding efficiency. Teams create clever balancer pools, leverage DeFi staging platforms, and utilize rebasing tokens to streamline reinvestment.

Structured products that isolate risk factors like slashing penalties or impermanent loss for LP providers help mitigate downside dangers. Insurance-like products enable better risk-sharing for staking participants.

Innovative participation models like proof-of-use allow active ecosystem contributors such as bug reporters and content creators to earn governance rights. Contribution ecosystems move beyond pure proof-of-stake to encourage value creation.

Enhancements across liquidity, automation, risk management and credentialing push staking functionality forward – enabling more creative application layer opportunities relying on robust decentralized participation.

NFT/Metaverse

In 2024, we expect NFTs to continue advancing beyond just representing ownership rights and instead encapsulating identity, reputation, and utility. For example, Instagram recently launched digital collectibles support, allowing display of authenticated NFT artworks on user profiles. Other ways could have a more real world adoption such as using NFTs for ticketing as driven by protocols such as Seatlab. This is part of a wider trend of major platforms leveraging NFTs as building blocks for identity and digital self-expression.

We expect layering reputation systems, loyalty programs, and interactive traits through smart contract extensions that attach metadata and unlock abilities directly to non-fungible tokens. For example, token bound accounts (ERC-6551) allow binding NFTs to dedicated wallets capable of holding other asset types.

As NFTs mature into persistent digital identities, we expect increased crossover into avatar entities and tokenized accessories for metaverse worlds. Hybrid approaches allow portable identity across chains without forfeiting proprietary community platforms. Equally, traits like reputation and privileges can translate into interactive behaviors within virtual environments.

However, seamless interoperability with external games, metaverses, and marketplaces remains critical for adoption. Emergent standards around digital asset schemas, permissions, and traits will be crucial here. We foresee concerted efforts around open frameworks to facilitate value flow across worlds while preserving self-sovereignty.

Over 2024, the line between ephemeral NFTs and persistent digital entities will blur, opening new avenues for utility and ownership both within and outside virtual realms. NFTs are progressing beyond just digital artworks into dynamic digital identities.

Conclusion

As we look to 2024 and beyond, the blockchain space continues to push forward with infrastructure and consumer facing refinements even amidst market turbulence – a sign of the industry maturing beyond speculation into viable alternatives delivering real-world value.

Advancements across zero-knowledge proofs, specialized blockchains, security tooling, tokenized asset ownership, simplified user experiences and multi-faceted staking point to an ecosystem enhancing its capabilities to enable the next waves of adoption by wider audiences.

Developments profiled in domains like machine learning confidentiality, interoperable custom networks, auditing automation, regulatory-compliant tokenization, abstracting complexity and creative participation continually compress the final barriers to mainstream decentralized usage.

Ethereum remains poised to solidify its dominance as the trust backbone bridging old and new economies thanks to gravitation effects from increasing specialization and institutional integration.

Of course, mainstream adoption horizons stretch over years rather than quarters. Various obstacles around user familiarity, developer productivity, social coordination and regulatory clarity will persist as integration funnels through successive phases.

But crypto’s decentralized ethos persists as a compelling vision channeling human coordination energy into fairer financial infrastructure for the world. And the swelling momentum behind building robust public tools hints at this future unfolding sooner than critics expect.

The solutions explored throughout this paper promise to uplift global communities by progressing the technology substratum coordinating value at internet scale. As exponential adoption introduces concomitant challenges, we must cling to optimistic realism balancing concrete impact with idealistic ambition.

Sources

[1] https://deltafund.io/research_post/trends-tech-we-are-excited-for-in-2023/

[2] https://www.ft.com/content/42c8d75f-9066-4ed7-9485-127327d20edf

[5] https://www.coindesk.com/learn/mica-eus-comprehensive-new-crypto-regulation-explained/

[6] https://www.linkedin.com/feed/update/urn:li:activity:7104731427102941184/

[7] https://blog.spectral.finance/the-state-of-zero-knowledge-machine-learning-zkml/

[8] https://medium.com/@ABCDE.com/en-why-we-invest-in-bitsmiley-a9d0c7254576

[9] https://usa.visa.com/solutions/crypto/auto-payments-for-self-custodial-wallets.html

[11] https://www.rwa.xyz

[13] https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

[14] https://l2beat.com/

[15] https://rwa.xyz/